1 Delivering Hope to Patients with Sickle Cell Disease The First Treatment Developed Specifically for Sickle Cell Disease in almost 20 years January 2019 JP Morgan Healthcare Conference Filed by MYnd Analytics, Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a - 12 of the Securities Exchange Act of 1934 Subject Corporation: MYnd Analytics, Inc. Commission File No.: 001 - 35527 .

2 2 Important Information IMPORTANT INFORMATION ABOUT THE TRANSACTIONS WILL BE FILED WITH THE SEC This communication is being made in respect of the proposed business combination involving MYnd Analytics, Inc. (“MYnd”) and Emm aus Life Sciences, Inc. (“Emmaus”). In connection with the proposed transaction, MYnd and Emmaus plan to file documents with the SEC, including the filing by MYnd o f a Registration Statement on Form S - 4 containing a Joint Proxy Statement/Prospectus and each of MYnd and Emmaus plan to file with the SEC other documents regarding the propos ed transactions. INVESTORS AND SECURITY HOLDERS OF MYND AND EMMAUS ARE URGED TO CAREFULLY READ THE JOINT PROXY STATEMENT/PROSPECTUS (WHEN AVAILABLE) AND OTHER DOCUME NTS FILED WITH THE SEC BY MYND AND EMMAUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS. Investors and securit y h olders may view these documents (when they are available) and other documents filed with the SEC at the SEC’s web site at www.sec.gov and by contac tin g MYnd Investor Relations at mynd@crescendo - ir.com. Investors and security holders may view the documents filed with the SEC on MYnd’s website at www. myndan alytics.com or through the SEC’s website at www.sec.gov. Investors and security holders are urged to read the Joint Proxy Statement/ Prospectus and other documents f ile d with the SEC before making any voting or investment decision in connection with the proposed transactions . PARTICIPANTS IN THE SOLICITATION MYnd, Emmaus and their respective directors and executive officers may be deemed participants in the solicitation of proxies wit h respect to the proposed transaction. Information regarding the interests of these directors and executive officers in the proposed transaction will be included in th e Joint Proxy Statement/Prospectus described above. Additional information regarding the directors and executive officers of MYnd is also included in MYnd’s proxy statement for its 2018 Annual Meeting of Shareholders, which was filed with the SEC on March 1, 2018, as updated in MYnd’s Annual Report on Form 10 - K for the fiscal year ended September 30, 201 8, and additional information regarding the directors and executive officers of Emmaus is also included in Emmaus’ proxy statement for its 2018 Annual Meeting of Stockho lde rs, which was filed with the SEC on August 23, 2018. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed transaction when it becomes available . NO OFFERS OR SOLICITATIONS This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an of fer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualifica tio n under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Ac t . CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS Certain statements in this communication, including statements relating to the Merger Agreement, the Merger and the other tra nsa ctions contemplated by the Merger Agreement and the combined company’s future financial condition performance and operating results, strategy and plans are “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 giving MYnd’s and Emmaus’ expectations or predictions of future financial or busines s p erformance or conditions. These forward - looking statements are subject to numerous assumptions, risks and uncertainties which change over time. Forward - looking statements speak only as of the date they are made and MYnd and Emmaus assume no duty to update forward - looking statements. In addition to factors previously disclosed in MYnd’s and Emmaus’ reports filed with the U.S. Securities and Exchange Commiss ion (the “SEC”) and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward - looking stateme nts and historical performance: the ability to NasdaqCM listing approval and meet other closing conditions to the Merger, including requisite approval by MYnd’s and Emmaus’ st ockholders on a timely basis or at all; delay in closing the Merger; the ability to effect the proposed spin - off; adverse tax consequences to shareholders of the proposed spin - o ff; disruption following the Merger; the availability and access, in general, of funds to fund operations and necessary capital expenditures. Other risks and uncertainties are more fully described in MYnd’ Annual Report on Form 10 - K for the year ended September 30, 2018 , and Emmaus’ Annual Report on Form 10 - K for the year ended December 31, 2017, each filed with the SEC, and in other filings that MYnd or Emmaus makes and will make with the SEC in connection with the proposed transactions, including the Joint Proxy Statement/Prospectus described herein under “Important Additional Information About t he Transaction Will be Filed with the SEC.” Existing and prospective investors are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof. The statements made in this Current Report on Form 8 - K and the exhibits attached hereto speak only as of the date stated herein, and subsequent events and d evelopments may cause MYnd’s or Emmaus’ expectations and beliefs to change. While MYnd or Emmaus may elect to update these forward - looking statements publicly at some p oint in the future, each of MYnd and Emmaus specifically disclaims any obligation to do so, whether as a result of new information, future events or otherwise, except as re quired by law. These forward - looking statements should not be relied upon as representing MYnd’s or Emmaus’ views as of any date after the date stated herein.

3 Safe Harbor Statement 3 This presentation contains forward - looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 , regarding the research, development and potential commercialization of pharmaceutical products . Such forward - looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual outcomes and results to differ materially from current expectations . Additional risks and uncertainties are described in reports filed by Emmaus Life Sciences, Inc . with the U . S . Securities and Exchange Commission, including its Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q . Emmaus is providing this information as of the date of this publication and does not undertake any obligation to update any forward - looking statements as a result of new information, future events or otherwise .

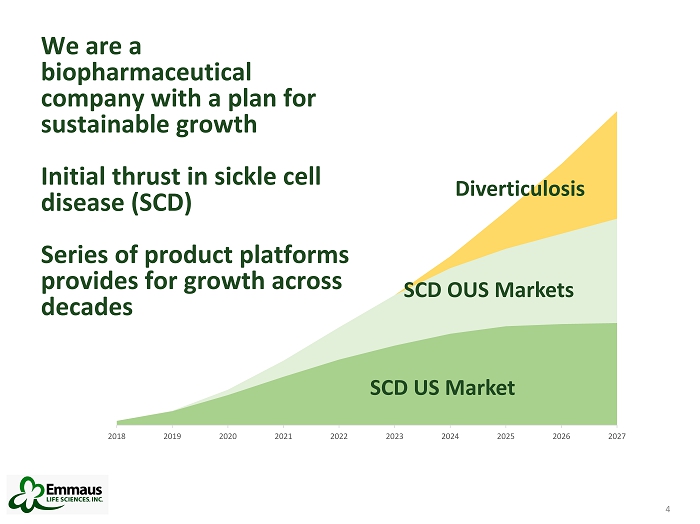

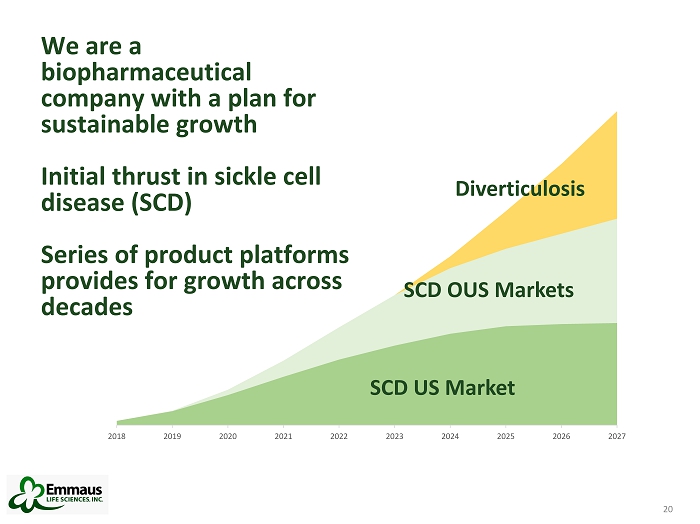

4 We are a biopharmaceutical company with a plan for sustainable growth Initial thrust in sickle cell disease (SCD) Series of product platforms provides for growth across decades 4 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 SCD OUS Markets Diverticulosis SCD US Market

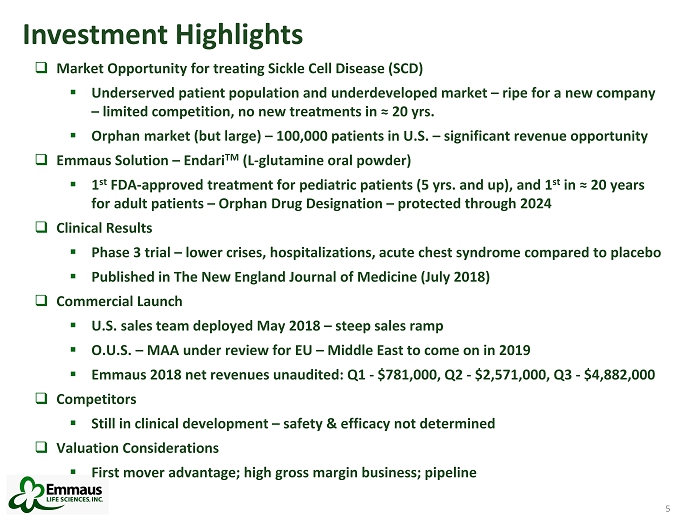

5 Investment Highlights □ Market Opportunity for treating Sickle Cell Disease (SCD) ▪ Underserved patient population and underdeveloped market – ripe for a new company – limited competition, no new treatments in ≈ 20 yrs. ▪ Orphan market (but large) – 100,000 patients in U.S. – significant revenue opportunity □ Emmaus Solution – Endari TM (L - glutamine oral powder) ▪ 1 st FDA - approved treatment for pediatric patients (5 yrs. and up), and 1 st in ≈ 20 years for adult patients – Orphan Drug Designation – protected through 2024 □ Clinical Results ▪ Phase 3 trial – lower crises, hospitalizations, acute chest syndrome compared to placebo ▪ Published in The New England Journal of Medicine (July 2018) □ Commercial Launch ▪ U.S. sales team deployed May 2018 – steep sales ramp ▪ O.U.S. – MAA under review for EU – Middle East to come on in 2019 ▪ Emmaus 2018 net revenues unaudited: Q1 - $781,000, Q2 - $2,571,000, Q3 - $4,882,000 □ Competitors ▪ Still in clinical development – safety & efficacy not determined □ Valuation Considerations ▪ First mover advantage; high gross margin business; pipeline 5

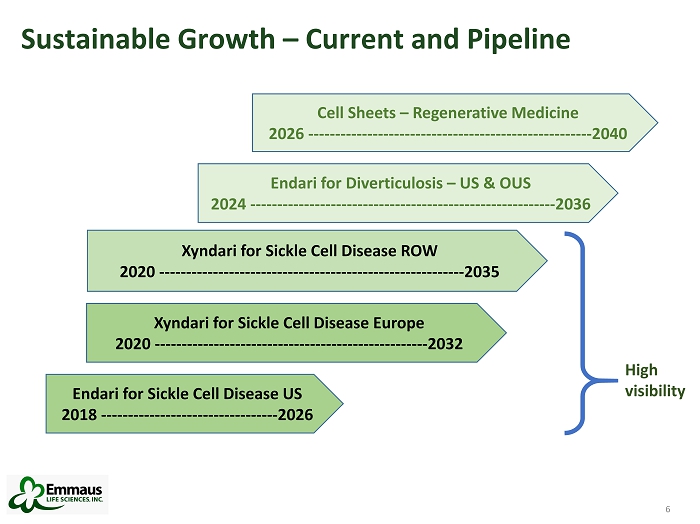

6 Sustainable Growth – Current and Pipeline 6 Endari for Sickle Cell Disease US 2018 --------------------------------- 2026 Xyndari for Sickle Cell Disease ROW 2020 --------------------------------------------------------- 2035 Xyndari for Sickle Cell Disease Europe 2020 --------------------------------------------------- 2032 Endari for Diverticulosis – US & OUS 2024 --------------------------------------------------------- 2036 Cell Sheets – Regenerative Medicine 2026 ----------------------------------------------------- 2040 High visibility

7 Financial Profile ▪ Initial funding by NIH and FDA ▪ Raised over $125m in total ▪ SEC voluntary reporting company – nontrading ▪ Beneficial ownership – officers and directors ≈ 40% ▪ Strong initial sales ▪ Cash burn nicely reduced by the steadily increasing revenues, break - even in the not - too - distant future ▪ Reverse merger 7

8 Reverse Merger Announced ▪ The surviving company will change its name to Emmaus Life Sciences ▪ Nasdaq - listed – MYnd [MYND] will spin off legacy business, assets and liabilities to its shareholders ▪ Emmaus’ ownership ratio of the combined entity will be approximately 94% ▪ Closing expected in Q2 2019, subject to closing conditions 8

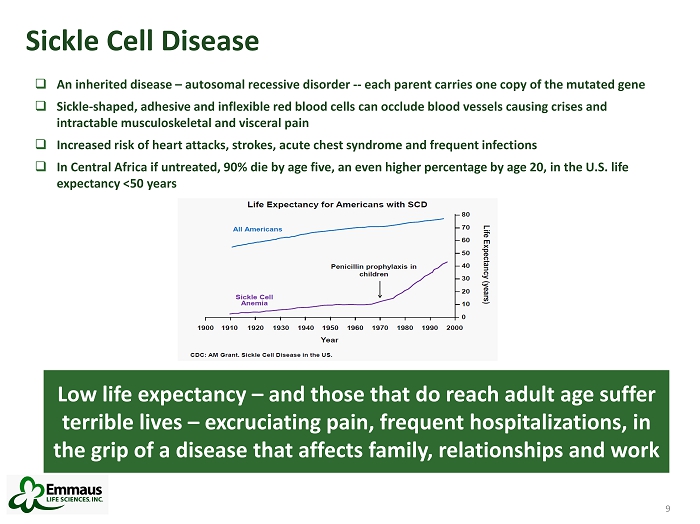

9 Sickle Cell Disease 9 Low life expectancy – and those that do reach adult age suffer terrible lives – excruciating pain, frequent hospitalizations, in the grip of a disease that affects family, relationships and work □ An inherited disease – autosomal recessive disorder -- each parent carries one copy of the mutated gene □ Sickle - shaped, adhesive and inflexible red blood cells can occlude blood vessels causing crises and intractable musculoskeletal and visceral pain □ Increased risk of heart attacks, strokes, acute chest syndrome and frequent infections □ In Central Africa if untreated, 90% die by age five, an even higher percentage by age 20, in the U.S. life expectancy <50 years

10 Market for Treatment of Sickle Cell Disease □ A Worldwide Issue ▪ Orphan Disease – U.S. (100,000) and Europe (80,000) ▪ Middle East, North Africa (MENA) region 500,000 patients ▪ High prevalence in Brazil, Rest of South America and Africa ▪ 20 to 25 million patients worldwide □ Unmet Medical Need – underserved, undertreated, underdeveloped market ▪ SCD occludes blood vessels causing crises and intractable pain ▪ Increased risk of heart attacks, strokes, acute chest syndrome and frequent infections □ Economic and Clinical Impact ▪ U.S. treatments exceeding $2 billion annually ▪ Some statistics point to an annual spend of $200,000 per patient per year ▪ 30 - day and 14 - day re - hospitalization rates of 33.4% & 22.1% in U.S. 10 20 to 25 million patients worldwide -- no new treatments in nearly 2 decades -- underserved, undertreated disease category – poised for disruption

11 Positioning our product Endari™ 11 Hospitalization Pain meds (opioids) Hydroxyurea Before… Endari™ ▪ Highly efficacious ▪ Well - tolerated ▪ Clean side - effect profile ▪ Orally administered ▪ Moderately priced Selectin inhibitors GBT’s Hb O₂ binding enhancer blu ebird’s Lenti - Globin Future… Endari™ a potential corner - stone therapy in the treatment of sickle cell disease – stand alone, or, with other existing treatments

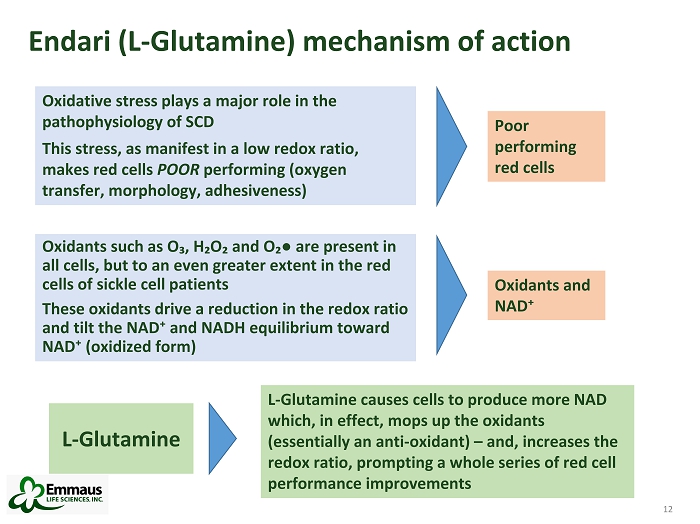

12 Endari (L - Glutamine) mechanism of action 12 Oxidants such as O₃, H₂O₂ and O₂ ● are present in all cells, but to an even greater extent in the red cells of sickle cell patients These oxidants drive a reduction in the redox ratio and tilt the NAD⁺ and NADH equilibrium toward NAD⁺ (oxidized form) Oxidative stress plays a major role in the pathophysiology of SCD This stress, as manifest in a low redox ratio, makes red cells POOR performing (oxygen transfer, morphology, adhesiveness) Poor performing red cells L - Glutamine causes cells to produce more NAD which, in effect, mops up the oxidants (essentially an anti - oxidant) – and, increases the redox ratio, prompting a whole series of red cell performance improvements L - Glutamine Oxidants and NAD⁺

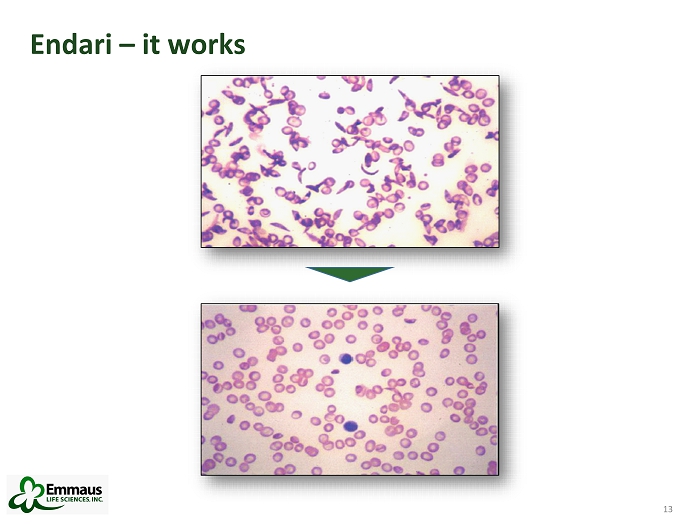

13 13 Endari – it works

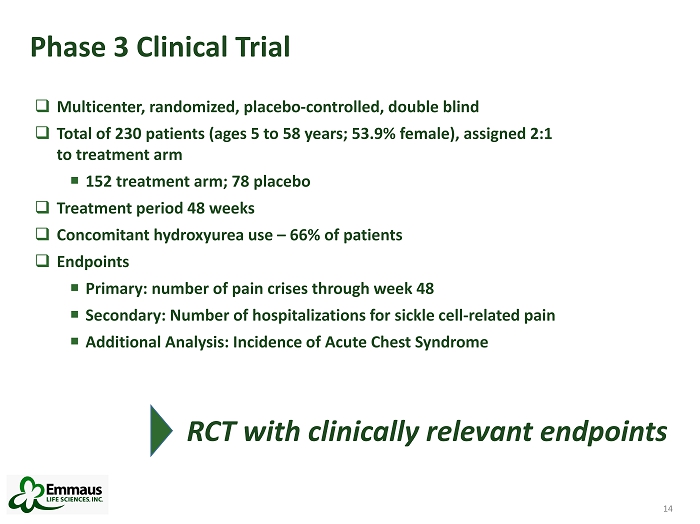

14 Phase 3 Clinical Trial 14 □ Multicenter, randomized, placebo - controlled, double blind □ Total of 230 patients (ages 5 to 58 years; 53.9% female), assigned 2:1 to treatment arm 152 treatment arm; 78 placebo □ Treatment period 48 weeks □ Concomitant hydroxyurea use – 66% of patients □ Endpoints Primary: number of pain crises through week 48 Secondary: Number of hospitalizations for sickle cell - related pain Additional Analysis: Incidence of Acute Chest Syndrome RCT with clinically relevant endpoints

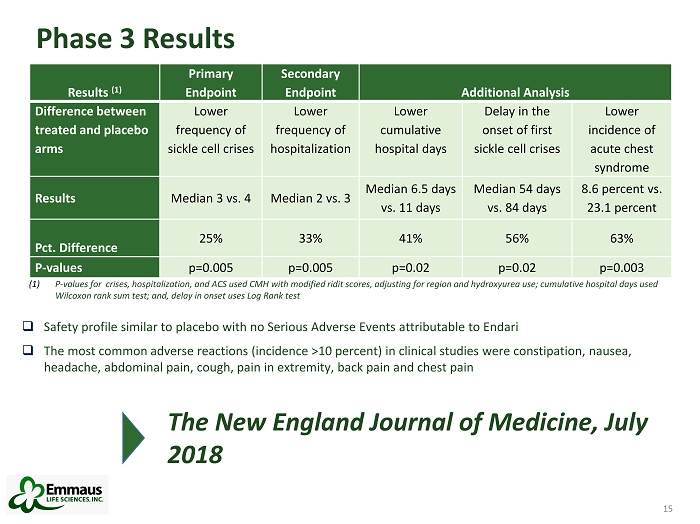

15 Phase 3 Results 15 Results (1) Primary Endpoint Secondary Endpoint Additional Analysis Difference between treated and placebo arms Lower frequency of sickle cell crises Lower frequency of hospitalization Lower cumulative hospital days Delay in the onset of first sickle cell crises Lower incidence of acute chest syndrome Results Median 3 vs. 4 Median 2 vs. 3 Median 6.5 days vs. 11 days Median 54 days vs. 84 days 8.6 percent vs. 23.1 percent Pct. Difference 25% 33% 41 % 56% 63 % P - values p=0.005 p=0.005 p=0.02 p=0.02 p=0.003 □ Safety profile similar to placebo with no Serious Adverse Events attributable to Endari □ The most common adverse reactions (incidence >10 percent) in clinical studies were constipation, nausea, headache, abdominal pain, cough, pain in extremity, back pain and chest pain (1) P - values for crises, hospitalization, and ACS used CMH with modified ridit scores, adjusting for region and hydroxyurea use; cumulati ve hospital days used Wilcoxon rank sum test; and, delay in onset uses Log Rank test The New England Journal of Medicine, July 2018

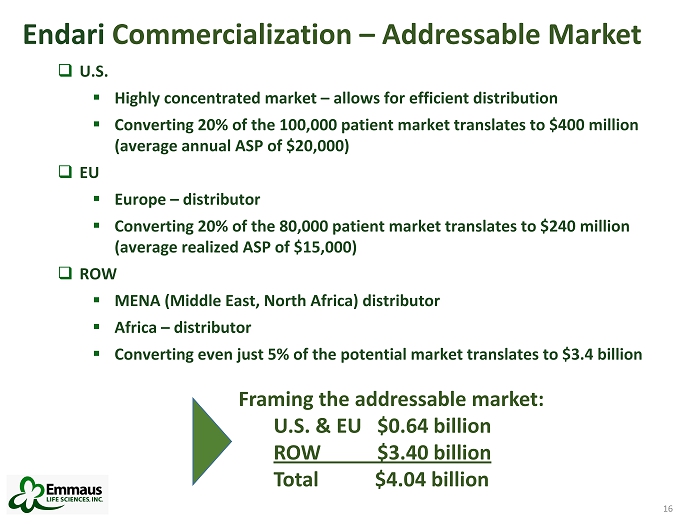

16 Endari Commercialization – Addressable Market □ U.S. ▪ Highly concentrated market – allows for efficient distribution ▪ Converting 20% of the 100,000 patient market translates to $400 million (average annual ASP of $20,000) □ EU ▪ Europe – distributor ▪ Converting 20% of the 80,000 patient market translates to $240 million (average realized ASP of $15,000) □ ROW ▪ MENA (Middle East, North Africa) distributor ▪ Africa – distributor ▪ Converting even just 5% of the potential market translates to $3.4 billion 16 Framing the addressable market: U.S. & EU $0.64 billion ROW $3.40 billion Total $4.04 billion

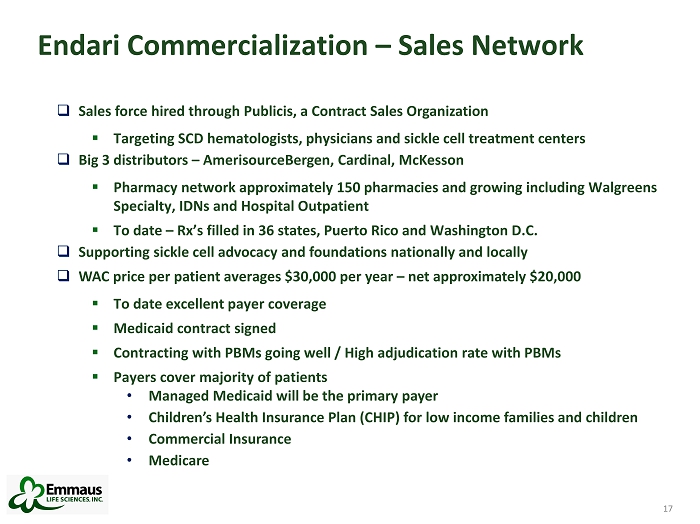

17 Endari Commercialization – Sales Network 17 □ Sales force hired through Publicis, a Contract Sales Organization ▪ Targeting SCD hematologists, physicians and sickle cell treatment centers □ Big 3 distributors – AmerisourceBergen, Cardinal, McKesson ▪ Pharmacy network approximately 150 pharmacies and growing including Walgreens Specialty, IDNs and Hospital Outpatient ▪ To date – Rx’s filled in 36 states, Puerto Rico and Washington D.C. □ Supporting sickle cell advocacy and foundations nationally and locally □ WAC price per patient averages $30,000 per year – net approximately $20,000 ▪ To date excellent payer coverage ▪ Medicaid contract signed ▪ Contracting with PBMs going well / High adjudication rate with PBMs ▪ Payers cover majority of patients • Managed Medicaid will be the primary payer • Children’s Health Insurance Plan (CHIP) for low income families and children • Commercial Insurance • Medicare

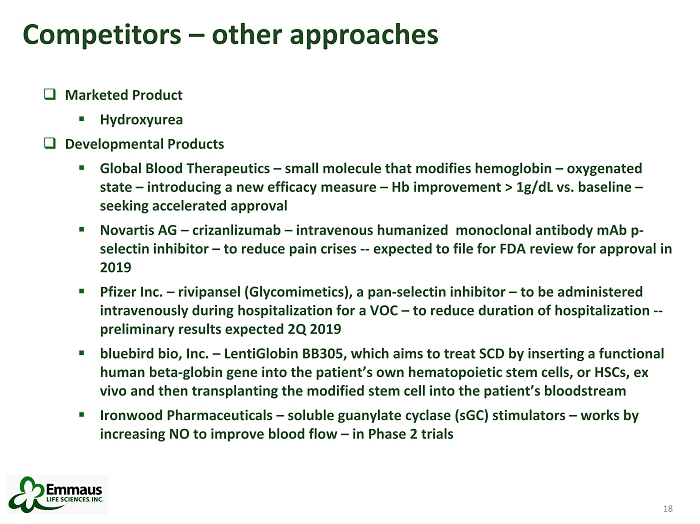

18 Competitors – other approaches □ Marketed Product ▪ Hydroxyurea □ Developmental Products ▪ Global Blood Therapeutics – small molecule that modifies hemoglobin – oxygenated state – introducing a new efficacy measure – Hb improvement > 1g/dL vs. baseline – seeking accelerated approval ▪ Novartis AG – crizanlizumab – intravenous humanized monoclonal antibody mAb p - selectin inhibitor – to reduce pain crises -- expected to file for FDA review for approval in 2019 ▪ Pfizer Inc. – rivipansel (Glycomimetics), a pan - selectin inhibitor – to be administered intravenously during hospitalization for a VOC – to reduce duration of hospitalization -- preliminary results expected 2Q 2019 ▪ bluebird bio, Inc. – LentiGlobin BB305, which aims to treat SCD by inserting a functional human beta - globin gene into the patient’s own hematopoietic stem cells, or HSCs, ex vivo and then transplanting the modified stem cell into the patient’s bloodstream ▪ Ironwood Pharmaceuticals – soluble guanylate cyclase (sGC) stimulators – works by increasing NO to improve blood flow – in Phase 2 trials 18

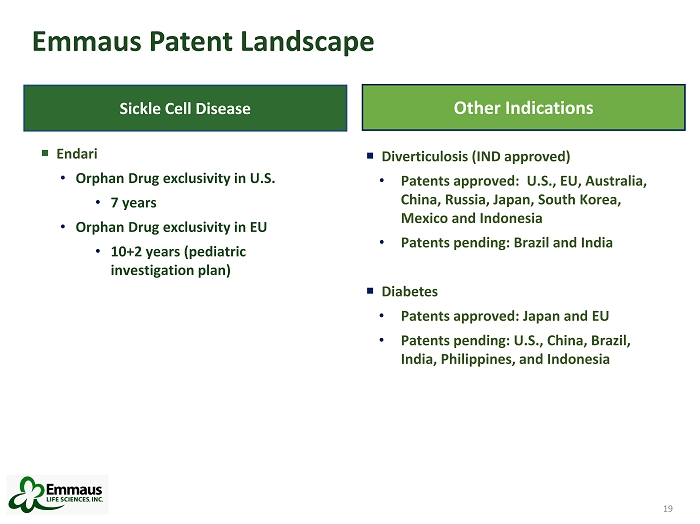

19 Emmaus Patent Landscape 19 Diverticulosis (IND approved) • Patents approved: U.S., EU, Australia, China, Russia, Japan, South Korea, Mexico and Indonesia • Patents pending: Brazil and India Diabetes • Patents approved: Japan and EU • Patents pending: U.S., China, Brazil, India, Philippines, and Indonesia Other Indications Sickle Cell Disease Endari • Orphan Drug exclusivity in U.S. • 7 years • Orphan Drug exclusivity in EU • 10+2 years (pediatric investigation plan)

20 We are a biopharmaceutical company with a plan for sustainable growth Initial thrust in sickle cell disease (SCD) Series of product platforms provides for growth across decades 20 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 SCD OUS Markets Diverticulosis SCD US Market

21 21 Contact : Kurt Kruger, CFO kkruger@emmauslifesciences . com