|

(4)

|

Date

filed:

|

CNS

RESPONSE, INC.

2755

Bristol Street, Suite 285

Costa

Mesa, CA 92626

September

15, 2009

Dear

Stockholder:

You are

cordially invited to attend the annual meeting of stockholders of CNS Response,

Inc. to be held on Tuesday, September 29, 2009 at 10:00 a.m., local time,

at the Island Hotel, 690 Newport Center Drive, Newport

Beach, California 92660. This meeting is very important. At this meeting,

CNS stockholders will vote to elect six directors to serve until the next annual

meeting of stockholders or until their successors are elected and

qualified. We have proposed a slate of director nominees consisting

of six of our current directors, including Tommy Thompson and John Pappajohn,

who just recently joined our board following the $2 million initial closing

of our private placement. We are very excited to have added Messrs.

Thompson and Pappajohn as directors at this critical time in CNS’s

development.

I hope

you will be able to attend the annual meeting in person. We consider

the votes of all of our stockholders to be important, whether you own a few

shares or many. Whether or not you plan to attend, please vote your shares as

soon as possible, following the instructions on the enclosed WHITE proxy

card. This will ensure that your shares are represented at the

meeting whether or not you are able to attend in person. Of course,

if you do attend the meeting and wish to vote in person, you may do

so.

As you

may know, CNS’s former CEO, Leonard J. Brandt, has been waging a campaign to try

to remove our current directors and elect himself and his own nominees either at

a stockholder meeting or through an action by written consent without a

meeting. He claims to have held a stockholder meeting on September 4, but

it is our position that Mr. Brandt's purported actions were invalid for a number

of reasons, including the fact that those actions were not permitted under our

bylaws. At this time, we do not know if he will attempt to nominate a slate

of directors or solicit proxies in connection with our annual meeting

or whether he is continuing to solicit consents to remove our current directions

and elect himself and his own nominees. If he does solicit proxies, we

expect that he will either oppose our slate of directors, attempt to nominate

himself and his own nominees, or both. Our board of directors believes that it

is in the best interests of CNS and its stockholders to elect our nominees and

reject Mr. Brandt’s attempts to seize control. If you wish to elect

our nominees, you should only vote using the WHITE proxy card that we are

sending you. These matters are more fully described in the accompanying proxy

statement.

OUR BOARD

OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF OUR

DIRECTOR NOMINEES.

Your vote is extremely

important. You may vote by proxy by mail, fax or email by completing,

signing, dating and returning the WHITE proxy card in the

postage-paid envelope provided or by scanning or faxing the proxy card to CNS at

the email address and fax numbers indicated in the proxy statement. You may

revoke your proxy at any time before it is exercised at our annual

meeting.

|

Very

truly yours,

|

||

|

/s/

George Carpenter

|

||

|

George

Carpenter

|

||

|

Chairman

of the Board of Directors and

Chief

Executive Officer

|

CNS

RESPONSE, INC.

2755

Bristol Street, Suite 285

Costa

Mesa, CA 92626

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS

HEREBY GIVEN that the Annual Meeting of Stockholders of CNS Response, Inc.

(“CNS”) will be held at the Island Hotel, 690 Newport Center Drive, Newport

Beach, California 92660 on Tuesday, September 29, 2009 at

10:00 a.m., local time for the purpose of considering and acting on the

following matters:

|

1.

|

To

elect six directors to serve until the next annual meeting of stockholders

or until their respective successors are elected and

qualified.

|

|

2.

|

To

transact such other business as may properly come before the meeting or

any adjournment thereof.

|

These

items are more fully described in the proxy statement accompanying this

Notice.

The board

of directors has fixed the close of business on Thursday, August 27, 2009 as the

record date for determining CNS stockholders entitled to notice of and to vote

at the annual meeting and any adjournment or postponement thereof.

Your vote is extremely

important. All CNS stockholders are cordially invited to

attend the annual meeting in person. Whether or not you plan to

attend in person, you are urged to mark, date, sign and return the enclosed

WHITE proxy card as

promptly as possible in the postage-prepaid envelope provided, or scan or fax

your completed proxy card to the email address and fax numbers indicated in the

proxy statement – this will ensure that your CNS shares are represented and that

a quorum is present at the annual meeting. If you submit your proxy

and then decide to attend the annual meeting and wish to vote your shares in

person, you may still do so. Your proxy is revocable in accordance with the

procedures identified in the accompanying proxy statement. Only CNS stockholders

of record at the close of business on Thursday, August 27, 2009 are entitled to

notice of, to attend and to vote at, the annual meeting.

As you

may know, CNS’s former CEO, Leonard J. Brandt, has been soliciting proxies and

written consents in an attempt to remove our current directors and elect himself

and his own nominees. He claims

to have held a stockholder meeting on September 4, but it is our position that

Mr. Brandt’s purported actions were invalid for a number of reasons, including

the fact that those actions were not permitted under our bylaws. At this time,

we do not know if he will attempt to nominate a slate of directors or solicit

proxies in connection with our annual meeting or whether he is continuing to

solicit consents to remove our current directors and elect himself and his own

nominees. If he does solicit proxies, we expect that he will either

oppose our slate of directors, attempt to nominate himself and his own nominees,

or both.

Any

communications you may receive from Mr. Brandt are not communications made,

authorized or endorsed by CNS. Although Mr. Brandt is currently a CNS

director, he is not being nominated by CNS to be elected as a director at the

annual meeting and his communications are made solely in his capacity as a CNS

stockholder. You should not consider any communication from him or

any statement made by him as being a statement by or on behalf of CNS or our

board of directors. You should assume that any contact he makes with

you is in his capacity as a stockholder, not as a director or representative of

CNS. THE BOARD OF

DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE BOARD’S NOMINEES

IDENTIFIED ON THE ENCLOSED WHITE PROXY CARD.

Important Notice Regarding Internet

Availability Of Proxy Materials For The Annual Meeting Of

Stockholders: This proxy statement, the accompanying

form of proxy card and CNS’s Annual Report (the “Annual Report”) are

available at www.cnsresponse.com. Pursuant to Securities and Exchange

Commission rules, we are providing you access to our proxy materials both by

sending you this full set of proxy materials and by notifying you of the

availability of our proxy materials on the Internet.

If you

have any questions or require any assistance with voting your shares, please

contact:

George

Carpenter, CEO

CNS Response, Inc.

gcarpenter@cnsresponse.com

|

By

order of the Board of Directors,

|

||

|

/s/

George Carpenter

|

||

|

George

Carpenter

|

||

|

Secretary

|

Costa

Mesa, California

September

15, 2009

IMPORTANT:

Whether or not you expect to attend the annual meeting in person, we urge you to

submit a completed WHITE proxy card to vote your shares. This will

help ensure the presence of a quorum at the annual meeting. Promptly

voting your shares will help to save CNS the expense of additional

solicitations. As described in the accompanying proxy statement,

submitting your WHITE proxy card now will not prevent you from voting your

shares at the annual meeting if you desire to do so.

TABLE

OF CONTENTS

|

PAGE

|

|||

|

ABOUT

THE MEETING

|

1

|

||

|

BACKGROUND

OF THE SOLICITATION

|

2

|

||

|

QUESTIONS

AND ANSWERS REGARDING THE ANNUAL MEETING

|

3

|

||

|

PROPOSAL NO.

1 – ELECTION OF DIRECTORS

|

8

|

||

|

INFORMATION

REGARDING THE BOARD OF DIRECTORS AND COMMITTEES AND COMPANY

MANAGEMENT

|

9

|

||

|

Director

Nominees

|

9

|

||

|

Other

Executive Officers

|

10

|

||

|

Board

Composition and Committees and Director Independence

|

11

|

||

|

Further

Information Concerning the Board of Directors

|

11

|

||

|

Compensation

of Directors and Officers

|

12

|

||

|

Stockholder

Communication

|

12

|

||

|

Code

of Ethics

|

12

|

||

|

EXECUTIVE

COMPENSATION

|

13

|

||

|

Compensation

Discussion and Analysis

|

13

|

||

|

Summary

Compensation Table

|

15

|

||

|

Grant

of Plan Based Awards in the Fiscal Year Ending September 30,

2008

|

16

|

||

|

Narrative

Disclosure to Summary Compensation Table and Grants of Plan-Based Awards

Table

|

17

|

||

|

Employment

Agreements

|

17

|

||

| 2006 Stock Incentive Plan | 18 | ||

|

Outstanding

Equity Awards at Fiscal Year End 2008

|

18

|

||

|

Director

Compensation

|

19

|

||

|

Securities

Authorized for Issuance Under Equity Compensation Plans

|

20

|

||

|

TRANSACTIONS

WITH RELATED PERSONS, PROMOTERS OR CERTAIN CONTROL PERSONS

|

21

|

||

|

AUDIT

RELATED MATTERS

|

26

|

||

|

Report

of Board of Directors on Audit Committee Functions

|

26

|

||

|

Services

Provided by the Independent Auditors

|

27

|

||

|

Pre-Approval

Policies and Procedures

|

27

|

||

|

Fees

Paid to Independent Registered Public Accounting Firm

|

27

|

||

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

|

28

|

||

|

OTHER

MATTERS

|

30

|

||

| Purported September 4 Stockholders Meeting |

30

|

||

|

Section

16(a) Beneficial Ownership Reporting Compliance

|

31

|

||

|

Stockholder

Proposals

|

31

|

||

|

Solicitation

of Proxies

|

31

|

||

|

Annual

Report on Form 10-K

|

31

|

||

|

APPENDIX

I – INFORMATION CONCERNING PERSONS WHO MAY

ASSIST

IN THE SOLICITATION OF PROXIES BY THE COMPANY

|

32

|

||

_________________________________________________________

THIS

PROXY STATEMENT ALSO INCLUDES THE WHITE PROXY CARD FOR YOUR USE IN

VOTING

FOR THE ELECTION OF DIRECTORS.

_________________________________________________________

CNS

RESPONSE, INC.

2755

Bristol Street, Suite 285

Costa

Mesa, CA 92626

_________________________________________

PROXY

STATEMENT

_________________________________________

ANNUAL

MEETING OF STOCKHOLDERS

TO

BE HELD SEPTEMBER 29, 2009

_________________________________________

ABOUT

THE MEETING

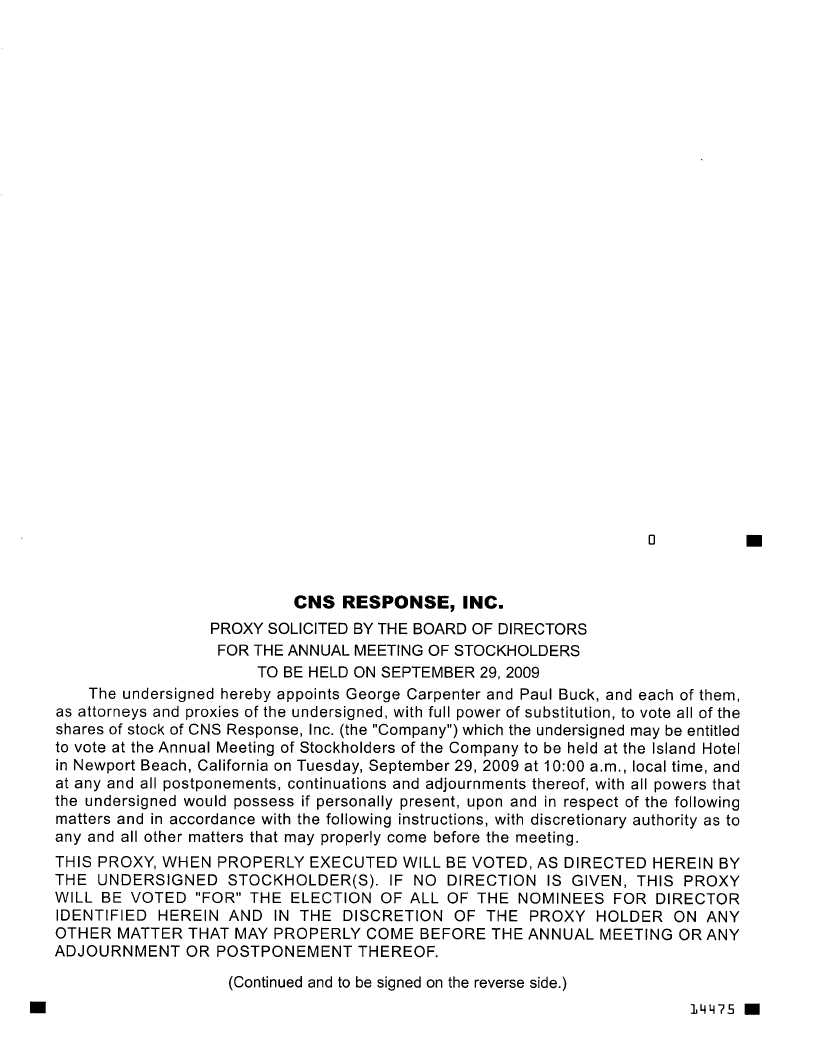

This

proxy statement is furnished in connection with the solicitation of proxies by

the board of directors of CNS Response, Inc. (“CNS,” the “Company,”

“we,” “our,” or “us”) for use in connection with CNS’s annual meeting of

stockholders (the “annual meeting” or the “meeting”), to be held on Tuesday,

September 29, 2009 at 10:00 a.m., local time, at the Island Hotel

in Newport Beach, California, and any adjournment or postponement

thereof. This proxy statement, the enclosed WHITE proxy card

and the Company’s 2008 Annual Report to Stockholders are being sent to

stockholders entitled to vote at the annual meeting.

At the

annual meeting, stockholders of record as of August 27, 2009 will be entitled to

vote in the election of directors. Our nominees for director

are:

|

Ÿ George

Carpenter

|

Ÿ John

Pappajohn

|

|

|

Ÿ Henry

Harbin, M.D.

|

Ÿ Tommy

Thompson

|

|

|

Ÿ David

B. Jones

|

Ÿ Jerome

Vaccaro, M.D.

|

All of

our nominees are currently serving as CNS directors, and Messrs. Pappajohn and

Thompson just recently joined the board. Mr. Pappajohn has recently

made significant investments in CNS and has more than 40 years’ experience as an

investor in life sciences and healthcare related companies and serves as a

member of the board of directors of a number of growing healthcare-related

companies. Mr. Thompson is the former Secretary of the U.S.

Department of Health and Human Services, a four-term governor of Wisconsin, and

is one of the nation's leading advocates for the health and welfare of all

Americans. Their biographies, along with the biographies of our other

nominees, are included later in this proxy statement.

We have

determined not to nominate Leonard J. Brandt for election as a

director. As you know, Mr. Brandt, who currently serves as a CNS

director, was removed by the board as the Company’s Chief Executive Officer in

April 2009. Since that time he has been waging a campaign to unseat

our other directors and replace them with himself and his own

nominees. He has already attempted to call purported special

meetings eight times since June and has solicited proxies and written

consents in connection with those purported meetings. He also claims

to have taken action at a purported stockholder meeting on September 4, but

it is our position that those purported actions were invalid for a number of

reasons, including the fact that those actions were not permitted under our

bylaws. At this time, we

do not know if he will attempt to nominate a slate of directors or solicit

proxies in connection with our annual meeting or whether he is continuing to

solicit consents to remove our current directors and elect himself and his own

nominees. If he does, we expect that he will either oppose our slate of

directors, attempt to nominate himself and his own nominees, or both.

Additional details concerning Mr. Brandt’s activities are discussed

elsewhere in this proxy statement.

Our board

of directors believes that it is in the best interest of CNS and its

stockholders to elect the nominees identified above. In the event

that Mr. Brandt attempts to propose himself and his own nominees for

election, we intend to oppose the election of Mr. Brandt and any of his

director nominees and any we also intend to oppose attempt by him to cause

the removal of our current directors through action by written

consent. THEREFORE,

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF OUR

DIRECTOR NOMINEES AND URGES YOU TO RETURN THE WHITE PROXY CARD AS SOON AS

POSSIBLE.

BACKGROUND

OF OUR SOLICITATION

We have

called our annual meeting and proposed the election of six nominees for

director. We believe these nominees will provide the type of

leadership that will help CNS move forward as we enter a critical phase in CNS’s

growth and development.

As you

know, CNS made an important change in April 2009 when the board of directors

dismissed Leonard J. Brandt as our CEO and replaced him with George Carpenter,

who had been serving as our President. The board decided to make this

change for a number of reasons, but the primary reasons were Mr. Brandt's

repeated failures to secure financing, his shortcomings as a manager, and a

fundamental disagreement between the other directors and Mr. Brandt regarding

the Company’s strategy. Mr. Brandt, after 12 months of being

unsuccessful in his efforts to secure acceptable financing for CNS, recommended

to the board that we reduce staff, discontinue payroll, notify our clinical

trial sites that further payments would be delayed or suspended, and use bridge

loans to “drip feed” CNS on a month-to-month basis. Our other

directors disagreed with this recommendation, and determined that Mr. Carpenter

was better qualified to lead our efforts to secure additional financing to

complete the clinical trial, continue to lay the groundwork for

commercialization and place CNS on a sound financial footing that we expect will

allow us to implement our business plan.

We

believe that Mr. Carpenter has made great progress over the last four months, as

evidenced by a variety of positive developments, including our successful

capital raising efforts that to date have resulted in over $2 million in

additional cash investment and the elimination of $1.7 million in indebtedness

through the automatic conversion of outstanding notes upon the completion of the

financing. He also has been instrumental in our efforts in getting

Messrs. Thompson and Pappajohn to join our board of directors. The

addition of Messrs. Thompson and Pappajohn, and their many years of relevant

experience in business, finance and government, strengthens our board’s ability

to face the challenges we anticipate as CNS continues its growth.

Unfortunately,

Mr. Brandt has spent the last four months reacting to his removal and engaging

in a number of activities that we believe have the goals of preventing our

financing initiatives and restoring himself to power. So far, those

efforts have not benefited CNS or our stockholders – they only have caused us to

incur significant legal and related expenses and have caused our management and

directors to spend valuable time contending with

Mr. Brandt. As you may know, to date Mr. Brandt has

attempted to call, hold, adjourn and/or reconvene purported special meetings

on eight

occasions since June and has made a number of SEC filings which we believe have

contained falsehoods and misleading statements and we have been vigorously

contesting these actions in both state and federal court. He now

even claims to have taken action at a purported stockholder meeting on September

4, even though he knows that the Company’s bylaws would not permit him to do so,

and is seeking to have a Delaware court validate his actions and prevent us from

having our annual meeting. Further information about these matters is

included under the caption “OTHER MATTERS – Purported

September 4 Stockholders Meeting.”

As part

of his campaign, Mr. Brandt has made a number of statements suggesting that his

purpose in calling his many meetings has been to allow CNS stockholders to

exercise their right to elect directors. In that vein, he has

criticized CNS for not holding a stockholder meeting that would allow

stockholders to elect directors – implying that CNS itself and other CNS

directors have been standing in the way of an annual meeting. He has

chosen not to highlight some relevant facts, however, when he makes these

statements – like the fact that he was CNS’s Chairman for many

years and, as Chairman, could have called a meeting at any time during his

tenure, a procedure that does not require the approval of any of the other

directors; or, that during his entire tenure as a director, he has never made a

motion at any meeting of directors to call an annual meeting, including at the

June 18 board meeting occuring just one day before he launched his campaign to

call his own meeting of stockholders. We believe that his initial purpose

in purporting to call a meeting in his capacity as a stockholder was to try to

catch the Company by surprise, act quickly to change the board and then tell the

rest of the stockholders what he had done. When that strategy did not

work, he tried again and again - a total of seven times - before he finally

delivered a proxy statement to CNS stockholders and invited other

stockholders beyond the short list he already had solicited to participate

in his purported meeting – not just those of you who were inclined to

travel to Dover, Delaware on a holiday, a Sunday or any of the other five

occasions Mr. Brandt’s designee stood in the hallway of an office building and

claimed he or she was convening a stockholder meeting. Then he

neglected to tell stockholders that he could not even call a meeting to elect

directors under our bylaws and Delaware law, that he had not complied with our

bylaw requirements regarding the process to be followed in calling a special

meeting generally, and that he unilaterally tried to set a record date that

conflicted with the record date set by our board, in an egregious attempt to

prevent certain CNS stockholders from voting at his purported

meeting.

Our goal

for the annual meeting is to have CNS stockholders elect directors after

considering the information contained in this proxy statement, assessing the

qualifications of our nominees, and reviewing the recent steps the board of

directors and our senior management have taken to stabilize the Company’s

finances, implement our business plan and set the stage for CNS’s

future. We believe that is the best way for you to be able to judge

our performance and plans for CNS and exercise your right to vote.

- 2

- -

QUESTIONS

AND ANSWERS REGARDING THE ANNUAL MEETING

Why

am I receiving these materials?

We are

sending you this proxy statement because the board of directors is soliciting

your proxy to vote at our annual meeting. This proxy statement

provides information regarding the matters that we will act on at the annual

meeting and summarizes the information you need in order to vote at the annual

meeting. You do not need to attend the annual meeting to vote your CNS

shares. Please read this proxy statement, as it contains important

information you need to know to vote at the annual meeting.

When

and where will the annual meeting take place?

The

annual meeting will be held on Tuesday, September 29, 2009 at 10:00 a.m., local

time, at the Island Hotel, 690 Newport Center Drive, Newport

Beach, California 92660.

Who

is soliciting my vote?

This

proxy statement and the WHITE proxy card are provided

in connection with the solicitation of proxies by our board of directors for the

annual meeting. Proxy materials, including this proxy statement and

the WHITE proxy card,

were filed by us with the Securities and Exchange Commission on September 3,

2009, and we are first making this proxy statement available to stockholders on

or around September 15, 2009.

What

am I being asked to vote on?

|

|

·

|

To

elect six directors to serve until the next annual meeting of stockholders

or until their respective successors are elected and

qualified.

|

|

|

·

|

To

transact such other business as may properly come before the meeting or

any adjournment thereof.

|

With

respect to the election of directors, the board of directors has fixed the

current number of directors at seven, but has acted to re-set the number of

authorized directors from seven to six in connection with the election of

directors at the annual meeting. This means that there will be six members of

the board following the annual meeting. The board has nominated one

individual for each position on the board to be filled at the annual

meeting. Those nominees are:

|

|

·

|

George

Carpenter

|

|

|

·

|

Henry

Harbin, M.D.

|

|

|

·

|

David

B. Jones

|

|

|

·

|

John

Pappajohn

|

|

|

·

|

Tommy

Thompson

|

|

|

·

|

Jerome

Vaccaro, M.D.

|

How

does the board of directors recommend that I vote?

Our board

of directors recommends that you vote “FOR” the election of each of

our director nominees.

Unless

you give other instructions on your WHITE proxy card, the persons

named as proxy holders on the WHITE proxy card will vote in

accordance with the recommendations of our board of directors. This

means that if you return an executed WHITE proxy card to us without

checking any of the voting boxes, the proxy will be voted “FOR” the election of each of

our director nominees.

Who

may vote at the annual meeting?

Our

common stock is the only class of voting shares. Holders of record of

our common stock at the close of business on August 27, 2009, the record date

for the annual meeting, are entitled to vote on each matter properly brought

before the annual meeting and at any adjournment or postponement of the

meeting.

How

many votes do I have?

CNS

stockholders have one vote for each share of common stock owned on the record

date on each matter properly brought before the annual meeting and at any

adjournment or postponement of the meeting.

- 3

- -

How

many votes may be cast by all stockholders?

As of the

close of business on August 27, 2009, 41,781,129 shares of our common stock were

outstanding and each share is entitled to one vote on each matter properly

brought before the annual meeting and at any adjournment or postponement of the

meeting.

How

do I vote?

You may

vote by attending the annual meeting and voting in person or by submitting a

proxy. The method of voting by proxy will be different depending on

whether your shares are held by you directly as the record holder or if your

shares are held in “street name” by a broker, bank or nominee on your

behalf.

|

|

·

|

Record

holders. If you hold your CNS shares as a record holder,

you may vote your shares by completing, dating and signing the WHITE proxy card that is

included with this proxy statement and promptly returning it in the

pre-addressed, postage paid envelope we are providing to

you. You also have the option of submitting your

proxy electronically via email or by fax by following the instructions

described below. You also have the right to vote in person at

the meeting, and if you choose to do so, you can bring the enclosed WHITE proxy

card or vote using the ballot provided at the annual

meeting.

|

If you

vote by proxy, your shares will be voted at the annual meeting in the manner

specified by you. If you sign, date and return your WHITE proxy card,

but do not specify how you want your shares voted,they will be voted by the

proxy holder as recommended by the board.

|

|

·

|

“Street name”

holders. If you hold your CNS shares in street name, you

are what is commonly known as a “beneficial owner,” and you should receive

a notice from your broker, bank or other nominee that includes

instructions on how to vote your CNS shares. Your broker, bank

or nominee may allow you to deliver your voting instructions over the

Internet and may also permit you to vote by telephone. You also

may request paper copies of the proxy statement and WHITE proxy

card from your broker. Because a beneficial holder is not the

stockholder of record, you may not vote these shares in person at the

annual meeting unless you obtain a “legal proxy” from the broker, bank or

other nominee that holds your shares, giving you the right to vote the

shares at the meeting.

|

If you

hold your shares in street name and do not provide your broker with specific

voting instructions regarding the election of directors, the broker will not be

able to vote your shares on your behalf because the broker does not have

discretionary authority to vote on certain non-routine items, such as director

elections that may be deemed to be contested elections – the broker

must receive voting instructions from you as the beneficial owner of the

shares.

Even

if you plan to attend the annual meeting, we ask that you vote your shares in

advance using the WHITE proxy card so that your vote will be counted if you

later decide not to attend the annual meeting.

To

vote for our nominees – George Carpenter, Henry Harbin, M.D., David B. Jones,

John Pappajohn, Tommy Thompson and Jerome Vaccaro, M.D. – you must follow the

instructions on the WHITE proxy card or attend the annual meeting in person and

vote by ballot for our nominees. Please also be aware that you cannot

vote for our nominees on any proxy card or consent form other than our WHITE

proxy card.

If you

have any questions about how to ensure that your shares are voted at the annual

meeting in accordance with your wishes, please contact:

George

Carpenter CEO

CNS Response, Inc.

gcarpenter@cnsresponse.com

Can

I send in my proxy by fax or by email?

Yes. You may

fax your completed and signed proxy card to us at (866) 294-2611. You also may

fax your completed and signed proxy card to American Stock

Transfer & Trust Company at (718) 921-8331. You also may email a

completed and signed proxy card to us by scanning your completed and signed

proxy card and emailing it to the attention of Paul Buck at

pbuck@cnsresponse.com.

How

many votes must be present to hold the annual meeting?

A quorum

must be present, in person or by proxy, for business to be transacted at the

annual meeting. The presence in person or by proxy of the holders of

a majority of the outstanding shares of our common stock entitled to vote at the

annual meeting will constitute a quorum for the transaction of business at the

annual meeting. Based on shares of our common stock outstanding on

the record date, 20,890,565 shares of our common stock must be present either in

person or by proxy for a quorum.

- 4

- -

Abstentions

and broker “non-votes” are counted as present and entitled to vote for purposes

of determining the presence or absence of a quorum. A broker

“non-vote” occurs when a broker or nominee holding shares for a beneficial owner

does not vote on a particular proposal because the broker or nominee does not

have discretionary voting power for that particular item and has not received

instructions from the beneficial owner. In order for us to determine

that enough votes will be present to hold the annual meeting and transact

business, we urge you to vote as soon as possible by submitting the WHITE proxy card.

What

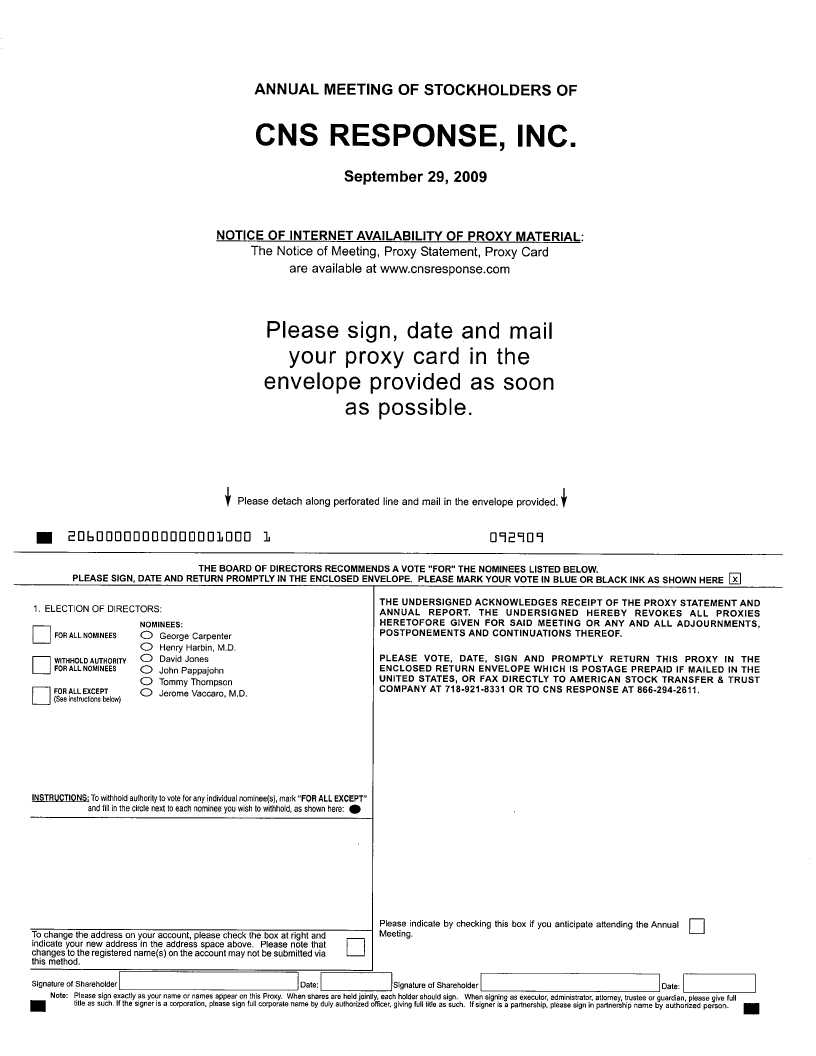

vote is required to elect the directors?

A

plurality of the voting power of the shares present in person or represented by

proxy at the annual meeting and entitled to vote on the election of directors is

required for the election of directors. This means that the six

nominees receiving the highest number of affirmative votes will be elected to

the Board of directors. There is no cumulative voting in the election

of directors.

How

will votes be counted?

With

respect to the election of directors, you may vote “FOR” or “WITHHOLD” on each

of the six nominees. “Withhold” votes and broker non-votes will not affect the

outcome of the election.

May

I revoke my vote?

You may

revoke your vote at any time before your proxy is voted at the annual

meeting. The action you must take to revoke your vote will be

different depending on whether your shares are held by you directly as the

record holder or if your shares are held in “street name” by a broker, bank or

nominee on your behalf.

|

|

·

|

Record

holders. If you hold your CNS shares as a record holder,

you may revoke your proxy at any time before your proxy is voted at the

annual meeting by (i) delivering to CNS a signed written notice of

revocation, bearing a date later than the date of the proxy, stating that

the proxy is revoked, (ii) signing and delivering a new paper proxy,

relating to the same shares and bearing a later date than the original

proxy, (iii) submitting another proxy by email or fax relating

to the same shares and bearing a later date than the original proxy, or

(iv) attending the annual meeting and voting in person, although

attendance at the annual meeting will not, by itself, revoke a

proxy.

|

|

|

·

|

“Street name”

holders. If you hold your CNS shares in street name, you

may change your vote by submitting new voting instructions to your broker,

bank or other nominee. You must contact your broker, bank or other nominee

to find out how to do so.

|

- 5

- -

Will

any other business be conducted at the annual meeting?

It is not

currently expected that any matter other than those identified above will be

voted upon at the annual meeting (other than procedural matters with respect to

the conduct of the meeting that may properly arise). With respect to

any other matter that properly comes before the meeting, the proxy holders will

vote as may be recommended by our board or, if no recommendation is given, in

their own discretion.

May

I vote in person?

Yes. If

you plan to attend the annual meeting and wish to vote in person, you will be

given a ballot at the annual meeting. Please note, however, that if your shares

are held in street name, you must bring to the annual meeting a “legal proxy”

from the record holder of the shares, which is the broker, bank or other

nominee, authorizing you to vote at the annual meeting.

What

do I need for admission to the annual meeting?

You are

entitled to attend the annual meeting in person only if you are a stockholder of

record or a beneficial owner of our stock as of the close of business on August

27, 2009, or if you hold a valid proxy for the annual meeting. To

attend the meeting, you must bring with you

|

|

·

|

photo

identification; and

|

|

|

·

|

if

you hold in “street name,” you should provide proof of beneficial

ownership on the record date, a copy of the WHITE voting-instruction

card provided by your broker, bank, or other nominee, or other similar

evidence of ownership as of the record date, as well as your photo

identification.

|

If you

are the stockholder of record, your name will be verified against the list of

stockholders of record prior to your admittance to the annual

meeting.

The use

of cameras, recording devices and other electronic devices at the annual meeting

is prohibited, and such devices will not be allowed in the meeting or any other

related areas, except by credentialed media. We realize that many cellular

phones personal digital assistants have built-in digital cameras, and while you

may bring these into the meeting venue, you may not use the camera function at

any time.

- 6

- -

What

happens if the annual meeting is postponed or adjourned?

Your

proxy will remain valid and may be voted when the postponed or adjourned meeting

is held. You may change or revoke your proxy until it is voted.

Who

pays for the solicitation of proxies?

We will

pay the cost of preparing this proxy statement and the related WHITE proxy card and notice of

meeting, as well as any other materials that may be distributed on behalf of our

Board, and any cost of soliciting your vote on behalf of the board. We also pay

all annual meeting expenses.

We may

use the services of our directors, officers, employees and others to solicit

proxies, personally or by mail, telephone, or facsimile. Appendix I to this

proxy statement sets forth information about the directors and other individuals

who, under rules promulgated by the Securities and Exchange Commission, are

“participants” in our solicitation of proxies in connection with the annual

meeting. We may also make arrangements with brokers, banks and other custodians,

nominees, fiduciaries and stockholders of record to forward solicitation

material to the beneficial owners of stock held of record by such persons. We

may reimburse such individuals or firms for reasonable out-of-pocket expenses

incurred by them in soliciting proxies, but we will not pay any compensation for

their services. We estimate that our total expenditures related to the

solicitation of proxies for the annual meeting will be approximately $

75,000. As of August 31, 2009, our total expenditures relating to

these solicitations have been approximately $25,000. We also

may engage a proxy solicitation firm to assist with the solicitation of proxies,

although we have not yet determined to do so, and we expect that if we do engage

a proxy solicitation firm that the additional cost to be borne by us will be

approximately $35,000.

May

I access the proxy materials for the annual meeting on the

Internet?

Under

recently implemented rules of the Securities and Exchange Commission, we are

providing access to our proxy materials both by sending you this full set of

proxy materials, including the WHITE proxy card,

and by notifying you of the availability of our proxy materials on the Internet.

This proxy statement, the accompanying form of WHITE proxy card

and the Company's Annual Report on Form 10-K (as amended) for the

fiscal year ended September 30, 2008 are available at

www.CNSResponse.com.

_______________________________________________

Note

Regarding Householding of Annual Meeting Materials

_______________________________________________

To reduce

the expenses of delivering duplicate proxy materials to our stockholders, we are

relying upon Securities and Exchange Commission rules that permit us to deliver

only one proxy statement and annual report to multiple beneficial owners who

share an address unless we received contrary instructions from any beneficial

owner at that address. If you hold your shares in “street name” (i.e., in the

name of a bank, broker or other nominee), share an address with another

beneficial owner, and have received only one proxy statement and annual report,

you may contact the bank, broker or other nominee to request a separate copy of

these materials or to discontinue householding. You may also request separate

copies of our proxy statement and annual report by contacting us

at:

CNS

Response, Inc., 2755 Bristol Street, Suite 285, Costa Mesa, CA 92626 –

attention: Corporate Secretary, or by calling us at (714)

545-3288.

- 7

- -

MATTERS

REQUIRING STOCKHOLDER ACTION

PROPOSAL NO.

1 – ELECTION OF DIRECTORS

Proposal 1 is for the election of six

directors to hold office until our next annual meeting of stockholders or until

their respective successors have been duly elected and qualified. Our

certificate of incorporation, as amended, provides that the number of directors

of the Company shall be fixed from time to time by our board of

directors. The board of directors has fixed the number of directors

at seven, and has acted to re-set the number of authorized directors to six in

connection with the election of directors at the annual meeting.

Unless

otherwise instructed, the proxy holders will vote the proxies received by them

“FOR” all of the nominees named below. If any nominee is unable or

unwilling to serve as a director at the time of the annual meeting, the proxies

will be voted for such other nominee(s) as shall be designated by the board of

directors to fill any vacancy, or, alternatively, the board may determine to

reduce the number of directors. We have no reason to believe that any nominee

will be unable or unwilling to serve if elected as a director.

Proxies may not be voted for more than

six directors. The six nominees receiving the highest number of affirmative

votes of the shares entitled to vote at the meeting will be elected.

Stockholders may not cumulate votes in the election of directors.

The board

of directors has nominated and proposes the election of the following nominees

as directors:

|

Ÿ George

Carpenter

|

Ÿ John

Pappajohn

|

|

|

Ÿ Henry

Harbin, M.D.

|

Ÿ Tommy

Thompson

|

|

|

Ÿ David

B. Jones

|

Ÿ Jerome

Vaccaro, M.D.

|

The

principal occupation and certain other information about the nominees and

certain executive officers are set forth on the following pages.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

ELECTION OF THE NOMINEES LISTED

ABOVE.

- 8

- -

INFORMATION REGARDING THE

BOARD OF DIRECTORS AND COMMITTEES AND COMPANY MANAGEMENT

DIRECTOR

NOMINEES

The

following table sets forth the name, age and position of each of our director

nominees as of August 31, 2009 and the current positions that they hold with

us:

|

Name

|

Age

|

Position Held

|

||

|

George

Carpenter

|

51

|

Chairman,

Chief Executive Officer and Secretary

|

||

|

Dr.

Henry T. Harbin

|

62

|

Director

|

||

|

David

B. Jones

|

65

|

Director

|

||

|

John

Pappajohn

|

81

|

Director

|

||

|

Tommy

Thompson

|

66

|

Director

|

||

|

Jerome

Vaccaro, M.D.

|

53

|

Director

|

George

Carpenter, Chairman of the Board, Chief Executive Officer,

Secretary

George

Carpenter has served as our Chief Executive Officer since April 10, 2009 and

prior to that date served as our President since October 1,

2007. Prior to joining us, Mr. Carpenter was the President & CEO

of WorkWell Systems, Inc., a national physical medicine firm that manages

occupational health programs for Fortune 500 employers. Prior to his

position at WorkWell Systems, Mr. Carpenter founded and served as Chairman and

CEO of Core, Inc., a company focused on integrated disability management and

work-force analytics. Core was acquired in 2001 by Assurant,

Inc. From 1984 to 1990, Mr. Carpenter was a Vice President of

Operations with Baxter Healthcare, served as a Director of Business Development

and as a strategic partner for Baxter's alternate site

businesses. Mr. Carpenter began his career at Inland Steel where he

served as a Senior Systems Consultant in manufacturing process control. Mr.

Carpenter holds an MBA in Finance from the University of Chicago and a BA with

Distinction in International Policy & Law from Dartmouth

College.

Henry

T. Harbin, M.D., Director

Henry

Harbin, M.D. joined our Board of directors on October 17, 2007. Dr.

Harbin is a Psychiatrist with over 30 years of experience in the behavioral

health field. He has held a number of senior positions in both public and

private health care organizations. He worked for 10 years in the public mental

health system in Maryland serving as Director of the state mental health

authority for three of those years. He has been CEO of two national

behavioral healthcare companies - Greenspring Health Services and Magellan

Health Services. At the time he was CEO of Magellan, it was the largest managed

behavioral healthcare company managing the mental health and substance abuse

benefits of approximately 70 million Americans including persons who were

insured by private employers, Medicaid and Medicare. In 2002 and 2003, he served

on the President's New Freedom Commission on Mental Health. As a part

of the Commission he was chair of the subcommittee for the Interface between

Mental Health and General Medicine. In 2005, he served as co-chair of

the National Business Group on Health's work group that produced the Employer's

Guide to Behavioral Health Services in December 2005. Since 2004, Dr. Harbin has

been providing health care consulting services to a number of private and public

organizations.

David

B. Jones, Director

David B.

Jones has been a director of CNS California since August 2006, and became a

director of the company upon completion of our merger with CNS California on

March 7, 2007. Mr. Jones currently serves as a partner of Sail

Venture Partners, L.P., a position which he has held since 2003. From

1998 to 2004, Mr. Jones served as Chairman and Chief Executive Officer of

Dartron, Inc., a computer accessories manufacturer. From 1985 to 1997, Mr. Jones

was a general partner of InterVen Partners, a venture capital firm with offices

in Southern California and Portland, Oregon. From 1979 to 1985, Mr. Jones was

President and Chief Executive Officer of First Interstate Capital, Inc., the

venture capital affiliate of First Interstate Bancorp. Mr. Jones is a graduate

of Dartmouth College and holds Masters of Business Administration and law

degrees from the University of Southern California.

John

Pappajohn, Director

John

Pappajohn joined the CNS board of directors on August 26, 2009. Since

1969, Mr. Pappajohn has been the President and sole owner of Pappajohn Capital

Resources, a venture capital firm, and President and sole owner of Equity

Dynamics, Inc., a financial consulting firm, both located in Des Moines,

Iowa. He serves as a director on the boards of the following public

companies: American CareSource Inc., Dallas, TX since 1994; since

1996; PharmAthene, Inc., Annapolis, MD., since 2007; Spectrascience, Inc., San

Diego, CA, since 2007; CareGuide, Inc., Florida, (formerly Patient

Infosystems, Inc.), since 1996; and ConMed Healthcare Management,

Inc., Hanover, MD since 2005.

- 9

- -

Tommy

Thompson, Director

Tommy G.

Thompson joined the CNS board of directors on August 26, 2009. Mr.

Thompson is the former Health and Human Services Secretary and four-term

Governor of Wisconsin is a partner at the law firm of Akin Gump Strauss Hauer

& Feld. He serves on the boards of CR Bard and Centene

Corporation, both which are public companies, and is Chairman of AGA Medical

Corporation, a privately-held company. Thompson served as HHS

Secretary from 2001 to 2005 and is one of the nation's leading advocates for the

health and welfare of all Americans. He is the 19th individual to serve as

Secretary of the department, which employs more than 60,000 personnel and has a

fiscal year 2005 budget of $584 billion. Thompson has dedicated his

professional life to public service and served as Governor of Wisconsin from

1987 to 2001. Thompson was re-elected to office for a third term in 1994 and a

fourth term in 1998. At HHS, Thompson led the Administration’s

efforts to pass and implement a new Medicare law that is for the first time

providing a drug benefit to America’s seniors. As governor, Thompson created the

nation's first parental school choice program in 1990, allowing low-income

Milwaukee families to send children to the private or public school of their

choice. He created Wisconsin's Council on Model Academic Standards, which

implemented high academic standards for English language arts, math, science and

social studies. Thompson began his career in public service in 1966 as a

representative in Wisconsin's state Assembly. He was elected assistant Assembly

minority leader in 1973 and Assembly minority leader in 1981. Thompson has

received numerous awards for his public service, including the Anti-Defamation

League's Distinguished Public Service Award. In 1997, Thompson received

Governing Magazine's Public Official of the Year Award, and the Horatio Alger

Award in 1998. Thompson served as chairman of the National Governors'

Association, the Education Commission of the States and the Midwestern

Governors' Conference. Thompson also served in the Wisconsin National Guard and

the Army Reserve.

Jerome

Vaccaro, M.D., Director

Jerome

Vaccaro, M.D., joined the Board of directors of CNS California in 2006 and

became a director of the company upon completion of our merger with CNS

California on March 7, 2007. Dr. Vaccaro is President and Chief

Operating Officer of APS Healthcare, Inc, (APS) a privately held specialty

healthcare company. Prior to his appointment as president of APS, Mr.

Vaccaro served as Senior Vice President with United Health Group’s Specialized

Care Services. He has served in a number of health care executive roles, most

recently as Chief Executive Officer of United Behavioral Health, and before that

as President and Chief Executive Officer of PacifiCare Behavioral Health

(“PBH”). Dr. Vaccaro has also served as Medical Director of PBH (1996-2001),

Chief Executive Officer of PacifiCare Dental and Vision (2002-2004), and Senior

Vice President for the PacifiCare Specialty Health Division (2002-2004). Dr.

Vaccaro has an extensive background in community mental health and public sector

work, including editing the textbook, “Practicing Psychiatry in the Community,”

which is hailed as the definitive community psychiatry text. Dr. Vaccaro

completed medical school and a Psychiatry Residency at the Albert Einstein

College of Medicine in New York City. After his training, Dr. Vaccaro served on

the full-time faculty of the University of Hawaii (1985-1989) and UCLA

(1989-1996) Departments of Psychiatry.

OTHER

EXECUTIVE OFFICERS

Daniel

Hoffman, Chief Medical Officer and President

Dr. Hoffman, 61, became our President

on April 10, 2009 and our Chief Medical Officer on January 15, 2008 upon our

acquisition of Neuro-Therapy Clinic, P.C, which at the time of the acquisition

was our largest customer. Dr. Hoffman is a Neuropsychiatrist with

over 25 years experience treating general psychiatric conditions such as

depression, bipolar disorder and anxiety. He provides the newest advances in

diagnosing and treating attentional and learning problems in children and

adults. Dr. Hoffman has authored over 40 professional articles, textbook

chapters, poster presentations and letters to the editors on various aspects of

neuropsychiatry, Quantitative EEG, LORETA, Referenced EEG, advances in

medication management, national position papers and standards, Mild Traumatic

Brain Injury, neurocognitive effects of Silicone Toxicity, sexual dysfunction

and other various topics. Dr. Hoffman has given over 58 major presentations and

seminars, including Grand Rounds at Universities and Hospitals, workshops and

presentations at national society meeting (such as American Psychiatric

Association and American Neuropsychiatric Association, national CME conferences,

insurance companies, national professional associations, panel member

discussant, and presenter of poster sessions. Dr Hoffman has a Bachelor of

Science in Psychology from the University of Michigan, an MD from Wayne State

University School of Medicine and conducted his Residency in Psychiatry at the

University of Colorado Health Sciences Center. During the past five years, Dr.

Hoffman has served as the President and CEO of Neuro-Therapy Clinic, P.C., a

wholly-owned subsidiary of the company that is focused on discovering ways to

integrate technology into the creation of better business

practices.

- 10

- -

BOARD

COMPOSITION AND COMMITTEES AND DIRECTOR INDEPENDENCE

Our board

of directors currently consists of seven members: George Carpenter, Henry

Harbin, David Jones, John Pappajohn, Tommy Thompson, Jerome Vaccaro and Leonard

Brandt. Messrs. Pappajohn and Thompson just recently joined our board

of directors on August 26, 2009; they were not members of the board during our

last fiscal year, which ended on September 30, 2008.

Currently,

we do not have any committees, including an audit committee, compensation

committee, or nominating and corporate governance committee and the functions

customarily delegated to these committees are performed by our full board of

directors. In addition, we do not have any charters that relate to

the functions traditionally performed by these committees. We are not

a “listed company” under SEC rules and are therefore not required to have

separate committees comprised of independent directors. We have, however,

determined that David Jones, Jerome Vaccaro, Henry Harbin, John Pappajohn and

Tommy Thompson are “independent” as that term is defined in Section 5600 of the

Nasdaq Listing Rules as required by the NASDAQ Stock Market. In

addition, although our full board of directors functions as our audit committee,

we have determined that Jerome Vaccaro, David Jones, John Pappajohn and Tommy

Thompson are “independent” for purposes of Rule 5605-4 of the Nasdaq Listing

Rules as required by the NASDAQ Stock Market.

We have

also determined that David Jones qualifies as an “audit committee financial

expert” within the meaning of the rules and regulations of the SEC and that each

of our other board members are able to read and understand fundamental financial

statements and have substantial business experience that results in that

member's financial sophistication. Accordingly, our board of directors believes

that each of its members has sufficient knowledge and experience necessary to

fulfill the duties and obligations that an audit committee would

have.

FURTHER

INFORMATION CONCERNING THE BOARD OF DIRECTORS

Meetings and

Committees. The Board of directors held six meetings during

its fiscal year ended September 30, 2008. All directors then serving, with the

exception of Mr. Vaccaro, attended 75% or more of all of the meetings of the

Board of directors during such fiscal year. The Company has not

established a specific policy with respect to members of the board of directors

attending annual stockholder meetings.

With

respect to our 2009 Annual Meeting of Stockholders, the board of directors

appointed a committee consisting of George Carpenter, Henry Harbin and David

Jones to review the director nominees and make recommendations to the full board

of directors regarding those candidates who will be the nominees for election or

re-election to our board of directors. This committee determined to

recommend George Carpenter, Henry Harbin, David Jones, John Pappajohn, Tommy

Thompson and Jerome Vaccaro as the nominees. The committee determined

not to recommend Leonard Brandt. The nominees were subsequently

approved by the board of directors. The methods used by the committee

and the board of directors for identifying candidates for election as directors

(other than those proposed by our stockholders, as discussed below) include the

solicitation of ideas for possible candidates from a number of sources—members

of the board of directors; our senior management; individuals personally known

to the members of the board of directors; and other research. We may also from

time to time retain one or more third-party search firms to identify suitable

candidates. The board also considers outside candidates for possible nomination

for election.

A CNS

stockholder may nominate one or more persons for election as a director at an

annual meeting of stockholders if the stockholder complies with the requisite

provisions contained in our Bylaws. In addition, the notice must be made in

writing and set forth as to each proposed nominee who is not an incumbent

Director (i) their name, age, business address and, if known, residence address,

(ii) their principal occupation or employment, (iii) the number of shares of

stock of the Company beneficially owned and (iv) any other information

concerning the nominee that must be disclosed respecting nominees in proxy

solicitations pursuant to Rule 14(a) of the Exchange Act of 1934. The

recommendation should be addressed to our Secretary.

- 11

- -

Among

other matters, our full board of directors which serves as the nominating and

governance committee:

|

|

·

|

Reviews

the desired experience, mix of skills and other qualities to assure

appropriate Board composition, taking into account the current Board

members and the specific needs of CNS Response and the

Board;

|

|

|

·

|

Conducts

candidate searches, interviews prospective candidates and conducts

programs to introduce candidates to our management and operations, and

confirms the appropriate level of interest of such

candidates;

|

|

|

·

|

Recommends

qualified candidates who bring the background, knowledge, experience,

independence, skill sets and expertise that would strengthen and increase

the diversity of the Board; and

|

|

|

·

|

Conducts

appropriate inquiries into the background and qualifications of potential

nominees.

|

Compensation of Directors and

Officers. Our full board of directors determines the compensation to be

paid to our officers and directors, with recommendations from management as to

the amount and/or form of such compensation. While our board may in the future

utilize the services of consultants in determining or recommending the amount or

form of executive and director compensation, we do not at this time employ

consultants for this purpose.

Stockholder

Communications. Stockholder may send communications to the

board of directors via email to board@cnsresponse.com or by telephoning the

Secretary at the Company’s principal executive offices, who will then relay the

communications to the board of directors.

Code of Ethics. Our

board of directors has adopted a Code of Ethical Conduct (the “Code of Conduct”)

which constitutes a “code of ethics” as defined by applicable SEC rules and a

“code of conduct” as defined by applicable NASDAQ rules. We require all

employees, directors and officers, including our principal executive officer,

principal financial officer and principal accounting officer to adhere to the

Code of Conduct in addressing legal and ethical issues encountered in conducting

their work. The Code of Conduct requires that these individuals avoid conflicts

of interest, comply with all laws and other legal requirements, conduct business

in an honest and ethical manner and otherwise act with integrity and in our best

interest. The Code of Conduct contains additional provisions that apply

specifically to our principal financial officer and other financial officers

with respect to full and accurate reporting. The Code of Conduct is available on

our website at www.cnsresponse.com

and is also filed as an exhibit to our Annual Report on Form

10-K/A.

- 12

- -

EXECUTIVE

COMPENSATION

COMPENSATION

DISCUSSION AND ANALYSIS

As we do

not have a designated compensation committee, our full board of directors

oversees matters regarding executive compensation. The Board is

responsible for, among other functions: (1) reviewing and approving corporate

goals and objectives relevant to the compensation of our executive officers and

evaluating the performance of such executive officers in light of these

corporate goals and objectives; (2) administering our 2006 Stock Incentive Plan

and other equity incentive plans that we may adopt from time to time; and (3)

negotiating, reviewing and setting the annual salary, bonus, stock options and

other benefits, direct and indirect, of the Chief Executive Officer, and other

current and former executive officers. The Board also has the authority to

select and/or retain outside counsel, compensation and benefits consultants, or

any other consultants to provide independent advice and assistance in connection

with the execution of its responsibilities. Our “named executive officers” for

our fiscal year ending September 30, 2008 were as follows:

|

·

|

George

Carpenter, President;

|

|

|

·

|

Horace

Hertz, Chief Financial Officer (resigned as of August 31,

2008);

|

|

|

·

|

Brad

Luce, Principal Financial Officer (resigned as of December 19,

2008);

|

|

|

·

|

Daniel

Hoffman, Chief Medical Officer; and

|

|

|

·

|

Leonard

Brandt, Chief Executive Officer

|

Compensation

Philosophy

Because

we are a small company with a total of 15 full-time and 4 part-time employees,

we do not have a formal comprehensive executive compensation

policy. As we expand our operations, we intend to establish such

policies to further our corporate objectives. Generally, we

compensate our executive officers with a compensation package that is designed

to drive company performance to maximize shareholder value while meeting our

needs and the needs of our executives. The following are objectives we

consider:

|

·

|

Alignment

- to align the interests of executives and shareholders through

equity-based compensation awards;

|

|

·

|

Retention

- to attract, retain and motivate highly qualified, high performing

executives to lead our growth and success;

and

|

|

·

|

Performance

- to provide, when appropriate, compensation that is dependent upon the

executive's achievements and the company’s

performance.

|

In order

to achieve the above objectives, our executive compensation philosophy is guided

by the following principles:

|

·

|

Rewards

under incentive plans are based upon our short-term and longer-term

financial results and increasing shareholder

value;

|

|

·

|

Executive

pay is set at sufficiently competitive levels to attract, retain and

motivate highly talented individuals who are necessary for us to strive to

achieve our goals, objectives and overall financial

success;

|

|

·

|

Compensation

of an executive is based on such individual's role, responsibilities,

performance and experience, taking into account the desired pay

relationships within the executive team;

and

|

|

·

|

Annual

performance of our company and the executive are taken into account in

determining annual bonuses with the goal of fostering a

pay-for-performance culture.

|

Compensation

Elements

We

compensate our executives through a variety of components, which may include a

base salary, annual performance based incentive bonuses, equity incentives, and

benefits and perquisites, in order to provide our executives with a competitive

overall compensation package. The mix and value of these components are impacted

by a variety of factors, such as responsibility level, individual negotiations

and performance and market practice. The purpose and key characteristics for

each component are described below.

- 13

- -

Base

Salary

Base

salary provides executives with a steady income stream and is based upon the

executive's level of responsibility, experience, individual performance and

contributions to our overall success, as well as negotiations between the

company and such executive officer. Competitive base salaries, in conjunction

with other pay components, enable us to attract and retain talented executives.

The Board typically sets base salaries for our executives at levels that it

deems to be competitive, with input from our Chief Executive

Officer.

Annual

Incentive Bonuses

Annual

incentive bonuses are a variable performance-based component of compensation.

The primary objective of an annual incentive bonus is to reward executives for

achieving corporate and individual goals and to align a portion of total pay

opportunities for executives to the attainment of our company's performance

goals. Annual incentive awards, when provided, act as a means to recognize the

contribution of our executive officers to our overall financial, operational and

strategic success.

Equity

Incentives

Equity

incentives are intended to align executive and shareholder interests by linking

a portion of executive pay to long-term shareholder value creation and financial

success over a multi-year period. Equity incentives may also be provided to our

executives to attract and enhance the retention of executives and to facilitate

stock ownership by our executives. The Board considers individual and company

performance when determining long-term incentive opportunities.

Health

& Welfare Benefits

The

executive officers participate in health and welfare, and paid time-off benefits

which we believe are competitive in the marketplace. Health and welfare and paid

time-off benefits help ensure that we have a productive and focused

workforce.

Severance

and Change of Control Arrangements

We do not

have a formal plan for severance or separation pay for our employees, but we

typically include a severance provision in the employment agreements of our

executive officers that have written employment agreements with

us. Generally, such provisions are triggered in the event of

involuntary termination of the executive without cause or in the event of a

change in control. Please see the description of our employment

agreements with each of George Carpenter and Daniel Hoffman below for further

information.

Other

Benefits

In order

to attract and retain highly qualified executives, we may provide our executive

officers with automobile allowances, consistent with current market

practices.

Accounting

and Tax Considerations

We

consider the accounting implications of all aspects of our executive

compensation strategy and, so long as doing so does not conflict with our

general performance objectives described above, we strive to achieve the most

favorable accounting (and tax) treatment possible to the company and our

executive officers.

Process

for Setting Executive Compensation; Factors Considered

When

making pay determinations for named executive officers, the Board considers a

variety of factors including, among others: (1) actual company performance as

compared to pre-established goals, (2) individual executive performance and

expected contribution to our future success, (3) changes in economic conditions

and the external marketplace, (4) prior year’s bonuses and long-term incentive

awards, and (5) in the case of executive officers, other than Chief Executive

Officer, the recommendation of our Chief Executive Officer. No specific weighing

is assigned to these factors nor are particular targets set for any particular

factor. Ultimately, the Board uses its judgment and discretion when determining

how much to pay our executive officers and sets the pay for such executives by

element (including cash versus non-cash compensation) and in the aggregate, at

levels that it believes are competitive and necessary to attract and retain

talented executives capable of achieving the Company's long-term

objectives.

- 14

- -

Summary

Compensation Table

The

following table provides disclosure concerning all compensation paid for

services to us in all capacities for our fiscal years ending September 30, 2008,

2007 and 2006 (i) as to each person serving as our principal executive officer

(“PEO”) or acting in a similar capacity during our fiscal year ended September

30, 2008, (ii) as to each person serving as our principal financial officer

(“PFO”) or acting in a similar capacity during our fiscal year ended September

30, 2008, and (iii) as to our two most highly compensated executive officers

other than our PEO and PFO who were serving as executive officers at the end of

our fiscal year ended September 30, 2008, whose compensation exceeded

$100,000. The people listed in the table below are referred to as our

“named executive officers”.

Subsequent

to our fiscal year ended September 30, 2008, on April 10, 2009, our board of

directors elected George Carpenter, at the time our President, to the position

of Chief Executive Officer and elected Daniel Hoffman, MD, to the position of

President in addition to his previous role as Chief Medical Officer of the

company. On the same date, our Board removed Mr. Brandt from his

position as our Chief Executive Officer.

|

Name

and

Principal

Position

|

Fiscal

Year

Ended

September

30,

|

Salary

($)

|

|

Bonus

($)

|

|

Option

Awards

($)

|

|

All

Other

Compensation

($)

|

|

Total

($)

|

||||||||||||

|

Leonard

Brandt (Chief Executive Officer, Principal Executive Officer,

Director)(1)

|

2008

|

175,000 | 0 | 0 | 19,000 | (9) | 194,000 | |||||||||||||||

|

2007

|

175,000 | 0 | 1,025,600 | (4) | 18,000 | 1,218,600 | ||||||||||||||||

|

2006

|

175,000 | 10,000 | 196,500 | (5) | 59,700 | 441,200 | ||||||||||||||||

|

Daniel

Hoffman (Chief Medical Officer)

|

2008

|

108,100 | 0 | 0 | 39,200 | (10) | 147,300 | |||||||||||||||

|

Horace

Hertz (former Chief

|

2008

|

157,900 | 0 | 0 | 0 | 157,900 | ||||||||||||||||

|

Financial

Officer, former Principal Financial Officer)(2)

|

2007

|

143,750 | 0 | 515,400 | (6) | 0 | 659,150 | |||||||||||||||

|

Brad

Luce (former Principal Financial Officer)(3)

|

2008

|

7,700 | 0 | 159,500 | (7) | 0 | 167,200 | |||||||||||||||

|

George

Carpenter (President)

|

2008

|

180,000 | 0 | 680,700 | (8) | 16,300 | (9) | 877,000 | ||||||||||||||

|

(1)

|

For

the fiscal years ended 2005 and 2006, Mr. Brandt agreed to forgo payment

of his salary and allow CNS California to accrue such compensation. In

August 2006, Mr. Brandt agreed to settle his claims for compensation

through September 30, 2006 in the aggregate amount of $1,106,900 in

exchange for the issuance of 298,437 shares of CNS California common

stock, which were exchanged for 298,437 shares of our common stock upon

the closing of our merger with CNS California on March 7,

2007.

|

|

(2)

|

Mr.

Hertz resigned on August 31, 2008.

|

|

(3)

|

Mr.

Luce resigned on December 19, 2008.

|

|

(4)

|

The

fair value of options was estimated on the date of grant using the

Black-Scholes option pricing model with the following weighted-average

assumptions: grant date fair value of $1.09; dividend yield of

0; risk free interest rate of 4.72%; expected volatility of 91% and an

expected life of 5 years.

|

|

(5)

|

Represents

options to purchase 2,124,740 shares of our common stock for which the CNS

California common stock underlying the originally issued options were

exchanged upon the closing of our merger with CNS

California. As of September 30, 2008, the options were fully

vested and exercisable at $0.132 per share. The fair value of

options was estimated on the date of grant using the Black-Scholes option

pricing model with the following weighted-average

assumptions: grant date fair value of $0.132; dividend yield of

0; risk free interest rate of 5.5%; expected volatility of 100% and an

expected life of 5 years. Subsequent to our year ended

September 30, 2008, Mr. Brandt exercised the aforementioned

options.

|

- 15

- -

|

(6)

|

The

fair value of options was estimated on the date of grant using the

Black-Scholes option pricing model with the following weighted-average

assumptions: grant date fair value of $1.09; dividend yield of

0; risk free interest rate of 4.72%; expected volatility of 91% and an

expected life of 5 years. On August 31, 2008, upon the

termination of his services to the company, options to purchase 352,757

shares of common stock held by Mr. Hertz were

cancelled.

|

|

(7)

|

The

fair value of options was estimated on the date of grant using the

Black-Scholes option pricing model with the following weighted-average

assumptions: grant date fair value of $0.59; dividend yield of

0; risk free interest rate of 3.41%; expected volatility of 211% and an