|

2755

Bristol Street, Suite 285

Costa

Mesa, CA 92626

T

714-549-5837

gcarpenter@cnsresponse.com

|

|

2755

Bristol Street, Suite 285

Costa

Mesa, CA 92626

T

714-549-5837

gcarpenter@cnsresponse.com

|

|

|

•

|

The

Company’s major multi-site clinical trial (the “Depression Efficacy

trial”) hadn’t completed recruiting and the Company didn’t have the money

to complete it.

|

|

|

•

|

Vendor

payables had been stretched, some for years, and many vendors looked like

they could be moving to termination or

litigation.

|

|

|

•

|

Paid

test volume was static, as was the

database.

|

|

|

•

|

The

Company had never scheduled an Annual Meeting under Len

Brandt.

|

|

|

•

|

CNS

Response was no longer a recognized corporate entity in Delaware, its

state of incorporation, due to failure to pay its corporate franchise

tax.

|

|

1.

|

Complete

the Depression Efficacy Trial

|

|

|

•

|

Situation

in April: The biggest single investment the Company has

made to date is its current multi-site Depression Efficacy

Trial. At the beginning of April, the Company began notifying

sites that it wouldn’t make payments on past invoices, due to a lack of

capital. There was deep concern within the team that sites

would terminate -- or slow -- their work with us, jeopardizing completion

of the trial.

|

|

|

•

|

90-day

objective: We resolved to complete recruiting in all sites by June,

perform an interim validation analysis to confirm that the study is

sufficiently powered, and endeavor to announce study results by

year-end.

|

|

|

•

|

Actions

& Results: Full effort has been maintained at all active trial

sites. We negotiated extended payment agreements with most

sites, and have honored those agreements. Overall, we’ve

reduced payables outstanding to trial sites by 25% and have increased our

speed of payment considerably.

|

|

|

✓

|

The

impact of continuing our study has been good: as all sites have

continued to participate and follow the study protocol, we are currently

on

track for a November release of top-line data at the U.S.

Psychiatric Congress, and a solid publication strategy

thereafter.

|

|

|

✓

|

Validation

study by biostatistician AMAREX was encouraging: our trial was

“powered” at fewer subjects than originally required, allowing us to end

recruiting for the study at 114 subjects on June 12,

2009.

|

|

2.

|

“Monetize

the test”

|

|

|

•

|

Situation

in April: During

this period, physicians using referenced-EEG®

in their practices continued to report exceptional results for their

patients, and many new physicians began training in the use of rEEG®. So

the question is, can we grow rEEG testing profitably? The

clinical trial is likely to attract significant attention to our

technology, but the real proof for investors will be in our ability to

monetize the test. Fortunately, there are some good

companies who have successfully commercialized similar biomarkers (e.g.

Genomic Health - GHDX), and we’re following their well-worn

path.

|

|

|

•

|

90-day

objective: Get the service team and physician network focused on an

achievable goal -- 100 tests per month by 12/09 -- with a

limited commercialization budget.

|

|

|

•

|

Actions

& Results

|

|

✓

|

Listening

to our physician partners has produced immediate

results. There’s always the question with new medical

technologies as to how widely they will be accepted and adopted by

physicians. rEEG is no different. However, there are

a dozen “early adopters” of rEEG who overcame those obstacles, and we can

learn much from them. For the first time, these users now

collaborate on a regular basis with the company and each other, sharing

best practices and product recommendations. We’ve invested

ourselves not only in improving the rEEG test, but in improving the

marketing and logistics of that test inside each physician

practice. And

we’re finally

moving forward with critical product development

projects to enhance our report and database.

|

|||

|

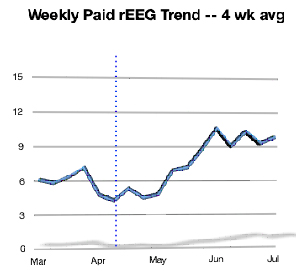

Test volume is up

sharply, mostly as a result of focus and attention on the

basics of testing operations with these top

physicians. Nevertheless, the numbers are still small and will

require a sustained effort to achieve our December goal.

|

|

|||

|

|

✓

|

Applying

the marketing

lessons from our clinical trial: long after the study

was “powered” and recruiting goals were achieved, a relatively modest

investment in web and other media was still generating

referrals. We are beginning to apply many of the same web-based

tools to generate testing volume within our physician

network.

|

|

|

✓

|

Management

review: we have organized our team to maximize focus and

accomplishment of short-term goals. As part of this

process, an independent management consultant interviewed each member of

the team shortly after the transition. Their report identified

significant improvement in productivity and morale since

April. Shareholders are welcome to contact any of our employees

(or ex-employees) to assess this improvement in management effectiveness

for themselves.

|

|

3.

|

Raise $4-5 million in

capital

|

|

|

·

|

Situation: Under

Len Brandt’s leadership, the Company spent considerable time and money

during 2008 and early 2009 attempting to raise money, but failed to

conclude any transaction for reasons which remain

unclear. The Company’s inability to raise money put the

company squarely in the position where it could only do a dilutive

financing once its cash reserves had been depleted. This

occurred in April.

|

|

|

•

|

Objective:

As of April we estimated that it would require $2.0 million to

operate the Company and complete the trial through the end of

2009, $480,000 to retire overdue payables to clinical trial

sites, and $600,000 to retire debt. Since April, we have

incurred unanticipated legal and other costs related to Len

Brandt’s actions which we estimate will exceed $300,000 by year

end. So, to run the company through year-end required a

minimum of $3,380,000, leading us to conclude that an equity financing

from $4-5 million would be necessary for the company to implement its

plan. We have raised $1.2 million of that amount so far in

convertible bridge notes, as outlined

below.

|

|

|

•

|

Actions

& Results:

|

|

|

✓

|

We

secured a well-known, successful venture capitalist -- John Pappajohn --

as lead investor. John brought our story and business

plans to institutions who will be critical to future equity

financing. Additionally, John invested $1 million in

bridge loans to the company, and SAIL Ventures invested another

$200,000. These funds were immediately employed to execute the

operating objectives described

above.

|

|

|

✓

|

The

company retired $150,000 in overdue vendor payables and $125,000 in

company debt. The Company is fully paid up and in good

standing in Delaware.

|

|

|

✓

|

The

practical effect of this effort has been to stabilize the company, take 5

million shares off the capitalization table, and position

the company to raise equity at a better

valuation than would have been possible

before.

|