e

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the fiscal year ended

OR

For the transition period from to

Commission File Number:

(Exact name of Registrant as specified in its charter)

2834 |

||

(State or Other Jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

Incorporation or Organization) |

Classification Code Number) |

Identification No.) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

None |

|

|

Securities Registered Pursuant to Section 12(g) of the Act:

Title of class |

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act:

Large accelerated filer |

☐ |

|

|

Accelerated filer |

☐ |

☒ |

|

|

Smaller reporting company |

||

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of shares of common stock held by non‑affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was $

There were

1

TABLE OF CONTENTS

ITEM |

|

|

PAGE |

|

3 |

||

|

|

|

|

|

4 |

||

|

|

||

ITEM 1. |

6 |

||

ITEM 1A. |

21 |

||

ITEM 1B. |

35 |

||

ITEM 1C. |

36 |

||

ITEM 2. |

36 |

||

ITEM 3. |

36 |

||

ITEM 4. |

36 |

||

|

|

||

ITEM 5. |

37 |

||

ITEM 6. |

37 |

||

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

38 |

|

ITEM 7A. |

46 |

||

ITEM 8. |

46 |

||

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

46 |

|

ITEM 9A. |

46 |

||

ITEM 9B. |

47 |

||

ITEM 9C. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS. |

47 |

|

|

|

||

ITEM 10. |

48 |

||

ITEM 11. |

51 |

||

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

53 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

55 |

|

ITEM 14. |

57 |

||

|

|

||

ITEM 15. |

58 |

||

65 |

|||

2

CAUTIONARY STATEMENT REGARDING FORWARD‑LOOKING STATEMENTS

This Annual Report contains some statements that are not purely historical and that are considered “forward‑looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Such forward‑looking statements express our management’s expectations, beliefs, and intentions regarding the future. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward‑looking statements, but the absence of these words does not mean that a statement is not forward‑looking.

The forward‑looking statements contained in this Annual Report are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be those currently anticipated. These forward‑looking statements involve risks, uncertainties (some of which are beyond our control) or assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward‑looking statements, including the factors referenced in this Annual Report under the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

All forward‑looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties, and you should not place undue reliance on any forward‑looking statement. We undertake no obligation to update or revise any forward‑looking statement, except as may be required under applicable securities laws.

3

RISK FACTOR SUMMARY

Following is a summary of certain material risks and uncertainties facing our business. This summary is not a complete discussion of the risk and uncertainties affecting us. A more complete discussion of these and other risks and uncertainties is set forth under “Risk Factors” in Part I, Item 1A of this Annual Report. Additional risks not presently known to us or that we presently deem immaterial may also affect us. If any of these risks occur, our business, financial condition or results of operations could be materially and adversely affected.

Risks Related to Our Business

We have operated at a loss and may continue to operate at a loss for the foreseeable future.

We are dependent on refinancing our existing indebtedness and new financing to sustain our operations, and there is substantial doubt regarding our ability to continue as a going concern.

We are dependent on the commercial success of our only approved product, Endari®.

The marketing exclusivity for Endari® for sickle cell disease (“SCD”) in the U.S. will expire in July 2024 and we may face competition from generic versions of L-glutamine oral powder, which could erode our Endari® sales in the U.S. and have a material, adverse effect on our results of operations.

Endari® has no marketing exclusivity in the Middle East North Africa ("MENA") region, which lack of exclusivity could adversely affect the commercial success of Endari® in the region.

A variety of risks associated with marketing Endari® internationally could hurt our business.

We face intense competition from companies with greater resources than us, and if our competitors are successful in marketing or developing alternative treatments, including generic versions of prescription-grade L-glutamine, our commercial opportunities may be reduced or eliminated.

The majority of Endari® sales are to a few customers and loss of a customer could adversely affect our results of operations.

If the single manufacturer of prescription-grade L-glutamine or, as happened recently the single packager upon which we rely for our finished goods inventory of Endari®, fails to produce in the volumes and quality that we require on a timely basis or fails to comply with stringent regulations applicable to pharmaceutical manufacturers, we may face interruptions in sales of, or be unable to meet demand for, Endari® and may lose potential revenues.

We have identified material weaknesses in our internal controls over financial reporting and governance matters.

Risks Related to Regulatory Oversight of Our Business and Compliance with Law

Endari® is subject to ongoing regulatory review, compliance with which may result in significant expense and limit our ability to commercialize Endari®.

If we fail to comply with federal and state healthcare laws, including fraud and abuse and health information privacy and security laws, we could face substantial penalties and our business, results of operations, financial condition and prospects could be adversely affected.

Risks Related to Our Investment in EJ Holdings, Inc.

EJ Holdings has no revenues and we have ceased funding its business and operations, and there is no assurance that EJ Holdings will be able to obtain needed financing to continue its activities.

If EJ Holdings fails to reactivate its plant and obtain customers, it may not be able to sell its plant and property and repay some or all our loans to EJ Holdings.

We have disposed of our former equity interest in EJ Holdings, which may increase the risk that our loans to EJ Holdings will not be repaid.

4

Risks Related to Our Securities

We have been delinquent in our SEC reporting obligations, and if we fail to timely file our future SEC reports, our security holders and prospective investors will not have current information regarding our financial statements and status of our business and operations and our common stock may no longer be eligible for quotation on the OTC Markets Group, Inc.

Our common stock is not traded on a national securities exchange, which may adversely affect our ability to raise needed financing.

Trading on the OTC Markets is volatile and sporadic, which could depress the market price of our common stock and make it difficult for our investors and stockholders to buy or resell our common stock.

Our outstanding warrants and convertible promissory notes may result in dilution to our stockholders.

Stockholders may experience dilution from future equity offerings.

5

PART I

ITEM 1. BUSINESS

In this Annual Report, the terms, “we,” “us,” “our” or the “Company” refer to Emmaus Life Sciences, Inc., and its subsidiaries.

Overview

Endari®

We are a commercial-stage biopharmaceutical company engaged in the discovery, development, marketing and sale of innovative treatments and therapies, primarily for rare and orphan diseases. Our lead product, Endari® (prescription grade L-glutamine oral powder) is approved by the U.S. Food and Drug Administration, or FDA, to reduce the acute complications of sickle cell disease (“SCD”) in adult and pediatric patients five years of age and older. Endari® has received Orphan Drug designation from the FDA, which designation affords marketing exclusivity for Endari® in the U.S. for a seven-year period expiring in July 2024.

Endari® is marketed and sold in the U.S. by our internal commercial sales team. Endari® is reimbursable by the Centers for Medicare and Medicaid Services, and every state provides coverage for Endari® for outpatient prescriptions to all eligible Medicaid enrollees within their state Medicaid programs. Endari® is also reimbursable by many commercial payors. We have agreements in place with the nation’s leading distributors, as well as physician group purchasing organizations and pharmacy benefits managers, making Endari® available at selected retail and specialty pharmacies nationwide.

SCD is a rare, debilitating and lifelong hereditary blood disorder that affects approximately 100,000 patients in the U.S. and up to 25 million patients worldwide, the majority of which are of African descent. Approximately one in every 365 African-American children are born with SCD. The FDA’s approval of Endari® was based upon the results of a 48-week randomized, double-blind, placebo-controlled, multi-center Phase 3 clinical trial evaluating the effects of Endari®, as compared to placebo in 230 adults and children with SCD. The results demonstrated that Endari® reduced the frequency of sickle cell crises by 25% and hospitalizations by 33%. Additional findings included a 41% decrease in cumulative hospital days and greater than 60% fewer incidents of acute chest syndrome in patients treated with Endari®. The FDA has acknowledged that the clinical benefit of Endari® was observed irrespective of hydroxyurea use, which supports the use of Endari® as a monotherapy or in combination with hydroxyurea as safe and effective treatment options for patients with SCD.

The safety of Endari® was based upon data from 298 patients, 187 treated with Endari® and 111 patients treated with placebo in Phase 2 and Phase 3 studies. Endari®’s safety profile was similar to the placebo and Endari® was well-tolerated in pediatric and adult patients alike. The most common adverse reactions, occurring in more than 10% of patients treated with Endari®, were constipation, nausea, headache, abdominal pain, cough, pain in extremity, back pain, and chest pain (non-cardiac).

6

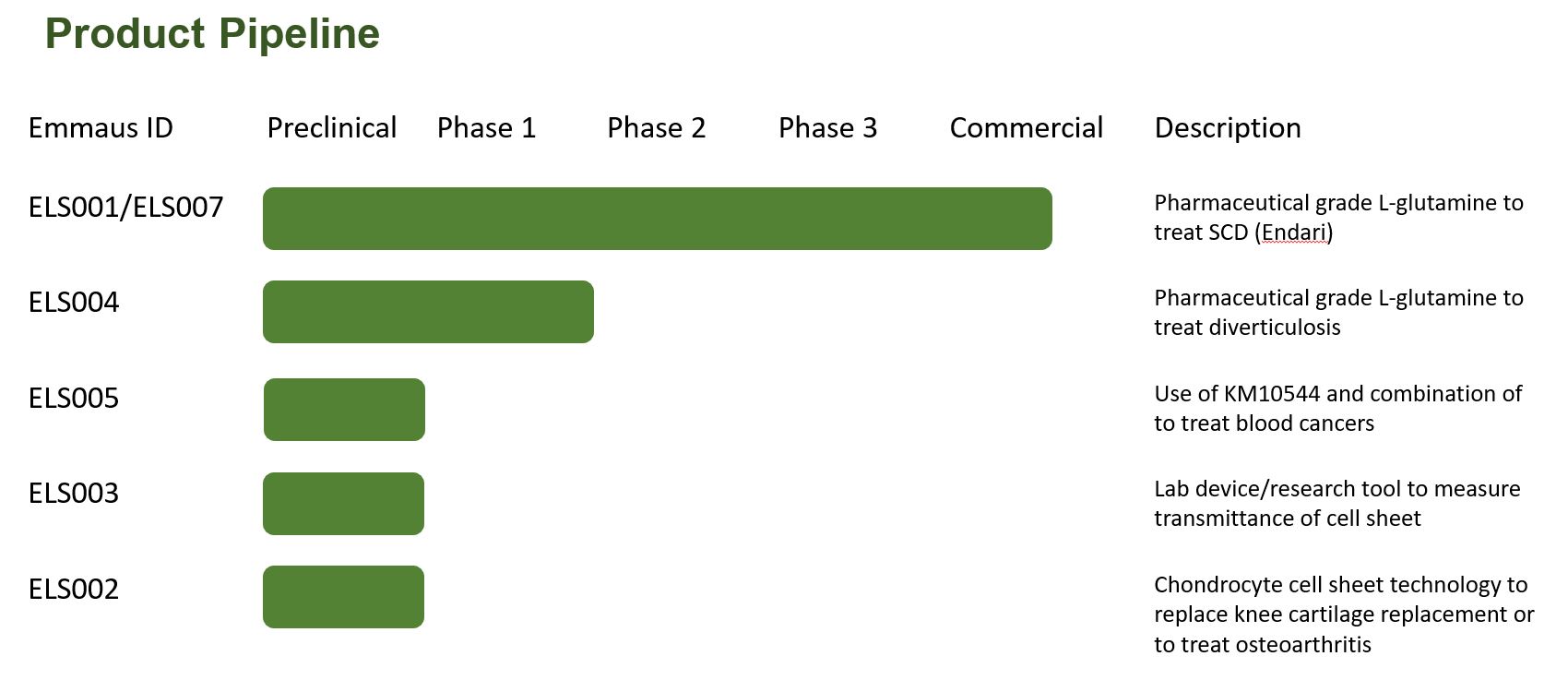

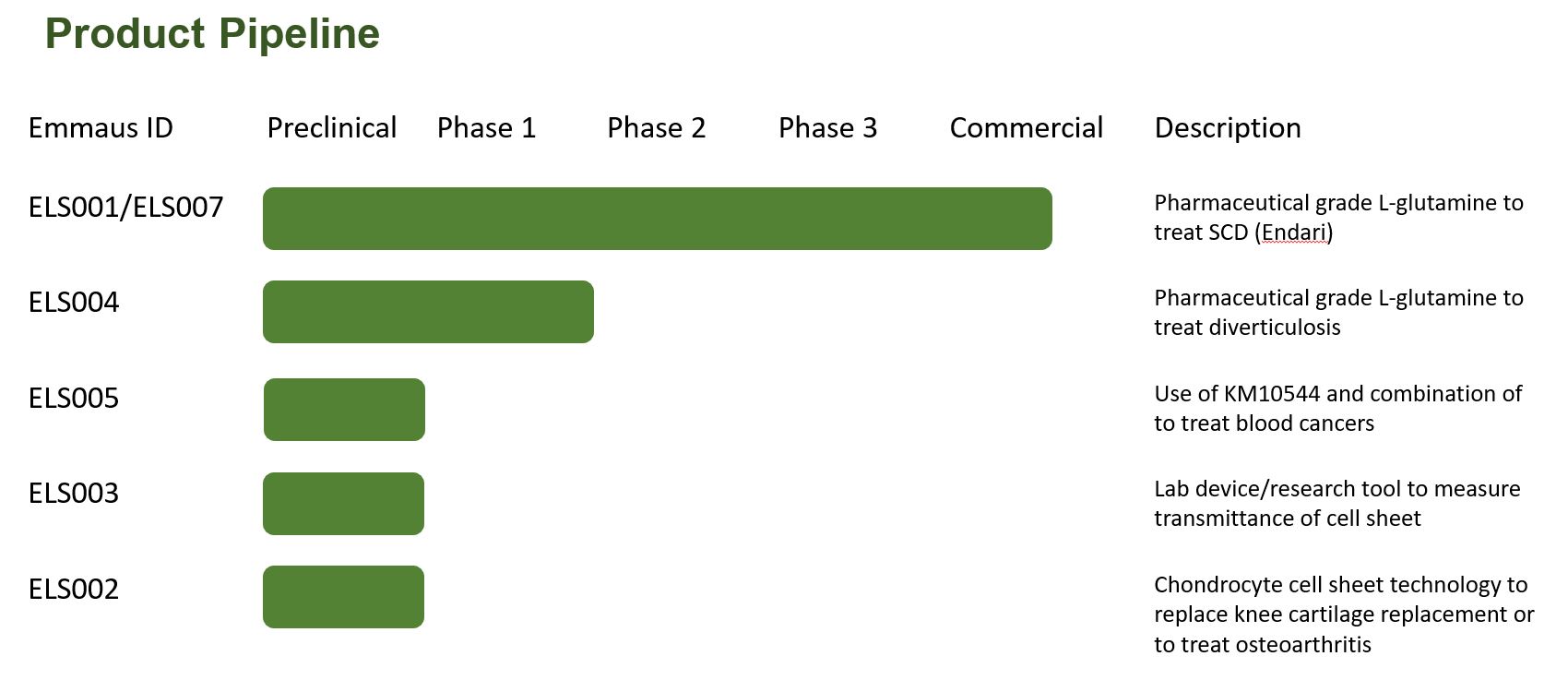

Product Pipeline

The following table summarizes our product pipeline:

Diverticulosis

On July 4, 2018, the FDA acknowledged receipt of our investigational new drug application, or IND, for the treatment of diverticulosis using the same prescription grade L-glutamine oral powder (“PGLG”) used for Endari® (L-glutamine oral powder). We subsequently received a “Study May Proceed” letter from the FDA. In April 2019, we commenced a Pilot/Phase 1 study of the safety and efficacy of PGLG oral powder in diverticulosis. The study evaluated the change in the number and size of colonic diverticula and assess safety in a total of 10 evaluable patients at multiple study sites.

The last patient visit for the pilot study was in November 2021. The data obtained after 12 months of treatment with L-glutamine was inconclusive, so we initiated a sub-study in June 2021, through an amendment to the original IND protocol. The sub-study standardized data collection and recording using video capture to support the accurate assessment of any changes in the sigmoid colon, the most frequent site for diverticulosis, as well as diverticulitis, a more severe manifestation of diverticulosis. The objective of the sub-study was to provide additional safety and efficacy data to support further clinical development. The sub-study colonoscopy procedures were assessed by a central medical monitor in addition to the treating investigator. For the sub-study, at least five patients were administered oral L-glutamine 15g BID over six months. The data from the sub-study, which was completed in July 2022, also was inconclusive. There were no safety concerns reported in either the Pilot/Phase 1 or the sub-study.

We may determine to undertake further investigation of the effectiveness of PGLG in patients with a history of diverticulitis but have no current plan to do so.

Oncology Project

On October 7, 2021, we entered into a License Agreement with Kainos Medicine, Inc., a South Korean corporation (“Kainos”), under which Kainos has granted us an exclusive license in the territory encompassing the U.S., the U.K. and the EU to patent rights, know-how and other intellectual property relating to Kainos’s novel IRAK4 inhibitor, referred to as KM10544, for the treatment of cancers, including leukemia, lymphoma, and solid tumor cancers. Although we achieved positive results in pre-clinical studies, we have suspended further studies of KM10544 and other research and development activities unrelated to commercialization and sale and possible reformulation of Endari®.

Chondrocyte Cell Sheet Technology

We have developed chondrocyte and osteoblast cell sheets using human mesenchymal stem cells and previously conducted pre-clinical studies to assess the potential of the cell sheets to articular cartilage injury, osteoarthritis and other

7

cartilage-related conditions and bone diseases such as osteoarthritis, nonunion and Paget’s disease. A cell sheet is a composite of cells grown and harvested in an intact sheet, like rather than as individual cells, and can be used for tissue transplantation or to engineer complex multilayer cell sheets composed of different types of cells like a bandage. Our cell sheets offer several potential advantages over existing treatment options, including reduced chemical toxins and xeno-products needed during cell sheet generation, easier and more convenient cell coverage of the injured tissue (transplantation on the damaged area), and allogeneic (i.e., use of stem cells from one individual in another individual) transplantation. We have suspended any further pre-clinical studies pending the availability of sufficient funding.

Device Measuring Cell Sheets Transparency

We also have developed a device for measuring the maturity of biological cell cultures for harvesting of cell sheets, as well as the number cells and the cell sheet transparency, in one or more cell sheets of the biological cell cultures. This semi-automatic device is a potentially essential tool for quality control in the growing field of cell sheet translational medicine. The potential application of this device includes assessment of the transparency of donor’s cornea before transplantation. Currently, there is no objective method to assess the timing for cell sheet harvesting and to assess the donor’s cornea transparency for corneal transplantation. We have filed a patent application in the U.S. for this technology and may seek a potential partner to develop or commercialize the device.

Summary of Pipelines Products

The development of our potential anti-cancer treatments, cell sheet technologies including chondrocyte cell sheets for treating cartilage and bone related conditions and CAOMECS for treating corneal and other diseases are in the early stages.

Recent Highlights

In February 2024, Endari was approved for marketing in Puerto Rico.

In July 2023, we received an Endari Marketing Authorization from the Oman Ministry of Health.

In May 2023, we received approval for marketing of Endari to treat SCD from the Bahrain National Health Regulatory Authority.

Sickle Cell Disease—Market Overview

Sickle cell disease (“SCD”) is a genetic blood disorder that affects 20 million - 25 million people worldwide and occurs with increasing frequency among those whose ancestors are from regions including sub-Saharan Africa, South America, the Caribbean, Central America, the Middle East, India and Mediterranean regions such as Turkey, Greece and Italy. The U.S. Centers for Disease Control and Prevention estimates that there are as many as 100,000 people with SCD in the United States, and we estimate there are approximately 80,000 SCD sufferers in the EU. We estimate that there are over 100,000 SCD patients that could potentially be treated in the Persian Gulf States, as well as patients in other countries that comprise the Middle East and North Africa (“MENA”) region.

SCD is characterized by the production of an altered form of hemoglobin which polymerizes and becomes fibrous, causing the red blood cells of patients with SCD to become sickle‑shaped, inflexible and adhesive rather than round, smooth and flexible. These changes also lead to increased oxidant stress and much damage to the membrane of red blood cells. It also causes increased adhesiveness of red blood cells. The complications associated with SCD occur when these inflexible and sticky cells block, or occlude, small blood vessels, which can then cause severe and chronic pain throughout the body due to insufficient oxygen being delivered to tissue, or ischemia, and inflammation. According to an article in Annals of Internal Medicine, “In the Clinic: Sickle Cell Disease” by M.H. Steinberg (September 2011), which we refer to as the Steinberg Article, this leads to long‑term organ damage, diminished exercise tolerance, increased risk of stroke and infection and decreased lifespan.

Sickle cell crisis, a broad term covering a range of disorders, is one of the most devastating complications of SCD. Types of sickle cell crisis include:

8

According to the Steinberg Article referred to above, acute chest syndrome affects more than half of all patients with SCD and is a common reason for hospitalization. Other symptoms and complications of SCD include swelling of the hands and feet, infections, pneumonia, vision loss, leg ulcers, gall stones and stroke.

A crisis is characterized by excruciating musculoskeletal pain, visceral pain and pain in other locations. These crises occur periodically throughout the life of a person with SCD. In adults, the acute pain typically persists for five or ten days or longer, followed by a dull, aching pain generally ending only after several weeks and sometimes persisting between crises. According to the Steinberg Article, the frequency of sickle cell crises varies within patients with SCD from rare occurrences to occurrences several times a month. The frequency of crises tends to increase late in the second decade of life and to decrease after the fourth decade.

Treatment of sickle cell crises is burdensome and expensive for patients and payors, as it encompasses costs for hospitalization, urgent care and emergency room visits and prescription pain medication. Endari® enhances nicotinamide adenine dinucleotide (“NAD”) synthesis to reduce excessive oxidative stress in sickle red blood cells, which is the cause of much of the damage leading to characteristic symptoms of SCD. We believe that Endari®, when taken daily, will decrease the incidence of sickle cell crisis by restoring the flexibility, fluidity and function of red blood cells in patients with SCD. We believe that regular use of Endari® also will reduce the number of costly hospitalizations of patients with SCD, as well as unexpected urgent care and emergency room visits.

Limitations of the Current Standard of Care

Prior to the approval of Endari®, the only other FDA approved pharmaceutical targeting sickle cell crisis was hydroxyurea, which is available in both generic and branded formulations. Hydroxyurea, a drug originally developed as an anticancer chemotherapeutic agent, has been approved as a once‑daily oral treatment for reducing the frequency of sickle cell crisis and the need for blood transfusions in adult patients with recurrent moderate to severe sickle cell crisis. In December 2017, the FDA granted Addmedica a regular approval for hydroxyurea (Siklos) to reduce the frequency of painful crises and the need for blood transfusions in pediatric patients two years of age and older with sickle cell anemia with recurrent moderate to severe painful crises. While hydroxyurea has been shown to reduce the frequency of sickle cell crisis in some patient groups, it is not suitable for many patients due to significant toxicities and side effects. In particular, hydroxyurea can cause a severe decrease in the number of blood cells in a patient’s bone marrow, which may increase the risk that the patient will develop a serious infection or bleeding, or that the patient will develop certain cancers. Another potential treatment option for SCD, bone marrow transplant, is limited in its use due to the lack of availability of matched donors and the risk of serious complications, including graft versus host disease, infection and potentially death, as well as by its high cost.

Two new treatments for sickle cell disease were approved by the FDA at the end of 2019. Crizanlizumab, marketed under the brand name of Adakveo® by Novartis AG, is a humanized monoclonal antibody that binds to P-selectin. It is approved by the FDA to reduce the frequency of vaso-occlusive crises in adults and pediatric patients aged 16 years and older with SCD. It is administered intravenously in two loading doses two weeks apart and every four weeks thereafter. Voxelotor, marketed under the brand name of Oxbryta™ by Pfizer Inc., is an HbS polymerization inhibitor that reversibly binds to hemoglobin to stabilize the oxygenated hemoglobin state, thus shifting the oxyhemoglobin dissociation curve. Oxbryta™ is approved by the FDA for the treatment of SCD in adults and pediatric patients 12 years of age and older. In December 2021, the FDA granted accelerated approval for Oxbryta to treat SCD in pediatric patients aged 4 to less than 12 years.

In December 2023, the FDA approved Casgevy, a groundbreaking CRISPR-based gene editing therapy from Vertex Pharmaceuticals and CRISPR Therapeutics. The FDA also approved a second treatment using conventional gene therapy, Bluebird Bio’s lentiviral therapy, Lyfgenia.

9

Upon onset of sickle cell crisis, the current standard of care is focused on pain management, often with prescription narcotics or non-prescription oral medications taken at home. If the pain is not relieved, or if it progresses, patients may seek medical attention in a clinic or emergency department. Pain that is not controlled in these settings may require hospitalization for more potent pain medications, typically opioids administered intravenously. The patient must stay in the hospital to receive these intravenous pain medications until the sickle cell crisis resolves and the pain subsides. Other supportive measures during hospitalization may include hydration, supplemental oxygen and treatment of any concurrent infections or other conditions.

According to Hematology in Clinical Practice, by Robert S. Hillman et. al. (5th ed. 2011), sickle cell crisis, once it has started, almost always results in tissue damage at the affected site in the body, increasing the importance of preventative measures. While pain medications can be effective in managing pain during sickle cell crisis, they do not affect or resolve the underlying vascular occlusion, tissue ischemia or potential tissue damage. Additionally, opioid narcotics that are generally prescribed to treat pain can also lead to tissue or organ damage and resulting complications and morbidities, prolonged hospital stays and associated continuation of pain and suffering. Given the duration and frequency of sickle cell crises, addiction to these opioid narcotics is also a significant concern.

Endari®, Our Solution for SCD

We believe Endari® may provide a safe and effective means for reducing the frequency of sickle cell crises in patients with SCD and the need for costly hospital stays or treatment with highly addictive pain medications such as opioid narcotics. Published academic research has identified L-glutamine as a precursor to NAD, one of the major molecules that regulate and prevent oxidative damage in red blood cells. Several published studies have demonstrated that sickle red blood cells have a significantly increased rate of transport of L-glutamine, which appears to be driven by the cells’ synthesis of NAD to protect against oxidative damage and thereby leading to further improvement in their regulation of oxidative stress. In turn this makes sickle red blood cells less adhesive to cells of the interior wall of blood vessels, which suggests that there is decreased chance of blockage of blood vessels, especially small ones. In summary, improved regulation of oxidative stress appears to lead to less obstruction or blockage of small blood vessels, thereby alleviating a major cause of the pain and other problems associated with SCD.

In December 2013, we completed a Phase 3 prospective, randomized, double blind, placebo controlled, parallel group multicenter clinical trial to measure, over a 48-week time frame, as its primary outcome, the reduction in the number of occurrences of sickle cell crises experienced by patients in the trial. All participants other than those who received placebo, including children, received up to 30 grams of Endari® daily, dissolved in liquid, split between morning and evening; the same dosage as our Phase 2 clinical trial completed in 2009. Patients were randomized to the study treatment using a 2:1 ratio of Endari® to placebo. The randomization was stratified by investigational site and hydroxyurea usage.

The clinical trial evaluated the efficacy and safety of Endari® in 230 patients (5 to 58 years of age) with sickle cell anemia or sickle β°-thalassemia who had 2 or more painful crises within 12 months prior to enrollment. Eligible patients stabilized on hydroxyurea for at least 3 months continued their therapy throughout the study. The trial excluded patients who had received blood products within 3 weeks, had renal insufficiency or uncontrolled liver disease, or were pregnant (or planning pregnancy) or lactating. Study patients received Endari® or placebo for a treatment duration of 48 weeks followed by 3 weeks of tapering.

10

Efficacy was demonstrated by a reduction in the number of sickle cell crises through Week 48 and prior to the start of tapering among patients that received Endari® compared to patients who received placebo. A sickle cell crisis was defined as a visit to an emergency room/medical facility for sickle cell disease-related pain which was treated with a parenterally administered narcotic or parenterally administered ketorolac. In addition, the occurrence of acute chest syndrome, priapism, and splenic sequestration were considered sickle cell crises. Treatment with Endari® also resulted in fewer hospitalizations due to sickle cell pain at Week 48, fewer cumulative days in hospital, longer time until first sickle cell crisis and a lower incidence of acute chest syndrome.

Table 1. Results from the Endari® Clinical Trial in Sickle Cell Disease

|

Endari |

Placebo |

Event |

(n = 152) |

(n = 78) |

Median number of sickle cell crises (min, max)1 |

3 (0, 15) |

4 (0, 15) |

Median number of hospitalizations for sickle cell pain (min, max)1 |

2 (0, 14) |

3 (0, 13) |

Median cumulative days hospitalized (min, max)1, |

6.5 (0, 94) |

11 (0, 187) |

Median time (days) to first sickle cell crisis (95% CI) 1,2 |

84 (62, 109) |

54 (31, 73) |

Patients with occurrences of acute chest syndrome (%)1 |

13 (8.6%) |

18 (23.1%) |

1. Measured through 48 weeks of treatment.

2. Hazard Ratio=0.69 (95% CI=0.52, 0.93), estimated based on unstratified Cox’s proportional model. Median time and 95% CI were estimated based on the Kaplan Meier method.

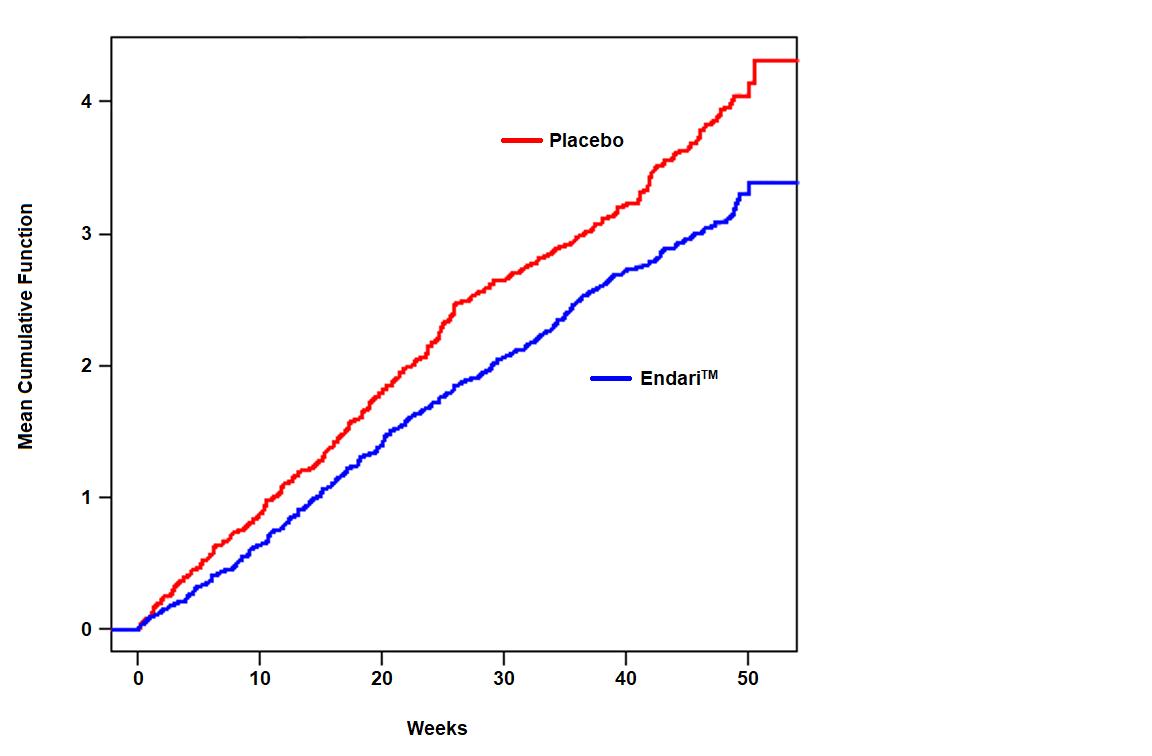

The recurrent crisis event time analysis (Figure 1) yielded an intensity rate ratio (IRR) value of 0.75 with 95% CI= (0.62, 0.90) and (0.55, 1.01) based on unstratified models using the Andersen-Gill and Lin, Wei, Yang and Ying methods, respectively in favor of Endari®, suggesting that over the entire 48- week period, the average cumulative crisis count was reduced by 25% from the Endari® group over the placebo group.

Figure 1. Recurrent Event Time for Sickle Cell Crises by Treatment Group

Endari® was studied in 2 placebo-controlled clinical trials (a phase 3 study, n=230 and a phase 2 study, n=70). In these trials, patients with sickle cell anemia or sickle β0-thalassemia were randomized to receive Endari® (n=187) or placebo (n=111) orally twice daily for 48 weeks followed by 3 weeks of tapering. Both studies included pediatric and adult patients (5-58 years of age) and 54% were female.

11

Treatment discontinuation due to adverse reactions was reported in 2.7% (n=5) of patients receiving Endari®. These adverse reactions included one case each of hypersplenism, abdominal pain, dyspepsia, burning sensation, and hot flash.

Commercialization and Distribution

United States

Our in-house commercial team encompasses marketing, market access, patient support, and distribution support personnel. The sales team consists of sales representatives and sales management personnel. We have a Commercial Patient Assistance Program (C- PAP) to provide financial assistance to eligible patients who are unable to afford their monthly co-payments for Endari®. We also maintain the Endari® Patient Support Program to provide eligible patients access to Endari® where appropriate.

Our sales and marketing efforts focus on the following groups: pediatric and adult hematologists who treat SCD patients, Community Based Organizations, or CBOs, government payors, insurance companies, and pharmacy benefit managers. SCD patients are primarily treated at specialized clinics located in children’s hospitals, university hospitals and community-based out-patient locations. The current focus of our sales team is as follows:

We have contracted with AmerisourceBergen Specialty Group (ASD Healthcare LLC), AmerisourceBergen Corporation companies, McKesson Plasma and Biologics LLC, a McKesson Corporation company, Cardinal Health 108, LLC, a Cardinal Health Inc. company, and CVS Caremark, L.L.C., a CVS Health Corporation company, to distribute Endari® to selected pharmacies and hospitals. AmerisourceBergen Corporation, McKesson Corporation Cardinal Health, Inc and Caremark are the four largest specialty distributors of prescription drugs in the U.S.

Our two largest distributors, ASD Healthcare LLC and McKesson Plasma and Biologics LLC, each account for more than 20% of net revenue for the year ended December 31, 2023. On a combined basis, these distributors accounted for approximately 43% of net revenue in 2023.

Outside the United States

We have entered into exclusive distribution agreements with strategic partners to register, commercialize and distribute Endari® in the Gulf Cooperation Council countries, or GCC, and other countries throughout the MENA region in collaboration with our branch office in Dubai. Marketing authorizations have been approved in the United Arab Emirates (March 2022), Qatar (November 2022), Kuwait (December 2022), Bahrain (May 2023) and Oman (July 2023) and our application for marketing authorization is pending in the Kingdom of Saudi Arabia.

We are party to an exclusive early access agreement pursuant to which our strategic partner distributes Endari® on an early access basis in France, the Netherlands and the U.K.

We also may seek future collaborations with other pharmaceutical or biotechnology companies and identify potential licensees and other international opportunities to commercialize Endari®, if approved by foreign regulatory authorities.

Diverticulosis

Diverticulosis, or the presence of colonic diverticula (i.e., pouches in the colon wall), is very common in industrialized nations, with its prevalence increasing with age. An estimated 40% of 60 year-olds and 70% of 80 year-olds have diverticulosis. Of these individuals, 10% to 25% are expected to develop diverticulitis, or the advancement of peri diverticular inflammation and infection, resulting in abdominal pain, nausea, vomiting, constipation, diarrhea, fever, and leukocytosis.

The pathogenesis of diverticulosis is believed to result from structural abnormalities of the colonic wall, disordered motility and low fiber diets. The relationships between glutamine and intestinal physiology have been extensively studied in ulcerative colitis and Crohn’s disease, short bowel syndrome and as a nutritional therapy for critical illnesses. Overall, glutamine elicits the following mechanisms of action within intestinal cells: promotion of enterocyte proliferation, regulation of tight junction proteins; suppression of pro-inflammatory signaling pathways; suppression of intestinal cell apoptosis and

12

cellular stress; and microbiome regulation. Glutamine also helps to maintain intestinal tissue integrity through various signaling pathways.

See the discussion above of our Pilot/Phase 1 study and substudy of the safety and efficacy of prescription grade L-glutamine oral powder in diverticulosis.

We are party to a distributor agreement with Telcon RF Pharmaceutical, Inc., or Telcon pursuant to which we granted Telcon exclusive rights to our PGLG oral powder for the treatment of diverticulosis in South Korea, Japan and China. The agreement contemplates that Telcon will be responsible at its expense for obtaining marketing authorization assuming FDA approval is obtained and for all other commercial activities in the territories. In exchange for the exclusive rights, Telcon paid us a $10 million upfront fee, which is refundable in the event of termination of the distributor agreement for failure to obtain FDA approval. See the “Raw Materials and Manufacturing,” below, for more information on our arrangements with Telcon.

Oncology Project

On October 6th, 2021, we licensed a small molecule (KM10544) targeting IRAK4 signaling pathway to treat leukemia and lymphomas. Leukemia is a cancer of blood-forming tissue causing high variation of its manifestation and therefore requiring many different treatment options. While there has been increase in survival rate by seven years from treatment of younger patient population (i.e., less than 60 years) since 1970, the survival rate has increased only one year for patients older than 60 years. Waldenstrom macroglobulinemia (WM) is a rare blood cancer that accounts for 1% to 2% of all hematological malignancies. In the U.S., around 1,000 to 5,000 new cases are detected each year. Many of the WM patients are asymptomatic making it difficult to detect and treat WM in its early stages.

We have conducted pre-clinical studies to assess KM10544’s efficacy in different cancer cell lines. Acute myeloid leukemia, acute lymphoblastic leukemia, Diffuse Large B Cell Lymphoma and Waldenstrom macroglobulinemia. In in vitro studies, KM10544 suppressed the proliferation and induced apoptosis (cell death) in those cancer cell lines with minimal toxic effects in healthy human cell lines, including human dermal fibroblasts and human adipose stromal cells. Depending on the availability of funds, we may undertake further in vivo testing to evaluate its toxicity (maximal dose and side effects) and to determine how KM-10544 can affect tumor elimination and delay of cancer growth.

This technology is supported by the PCT Patent International Application No. PCT/US2022/023632 filed on June 4th, 2022, entitled "Compositions and Methods for Treating Cancer."

Chondrocyte Cell Sheet Technology

We have developed human cartilage and bone multilayer cell sheets using human adult mesenchymal stem cells and are conducting preclinical studies to assess the restorative properties of these cell sheets. Cartilage cell sheets have the potential to treat diseases such as articular cartilage injury and osteoarthritis. Bone cell sheets are potentially useful in treating diseases such as osteoarthritis, nonunion and Paget’s disease. This cell sheet technology offers several potential advantages over the existing treatment options. The harvesting does not require any special treatment, such as the use of enzymes which could be harmful to the treated cells and patients. Current treatments options involve the injection of individual cells to the damaged area, which requires identification of precise injection location and multiple injections due to rapid cell death. In addition, injection of single cells could have a long-term effect with an ectopic settlement of cells leading to impairment of organ function. In contrast, cell sheet technology allows wider coverage of needed cells to the damaged cartilage and higher cell survival due to the cell sheet structure.

Unlike existing cell therapies, our cell sheets can be produced from mesenchymal stem cells from donors for use on other patients, referred to as allogeneic transplantation. Due to the mesenchymal stem cells unique immune properties the risk of immune rejection is lower compared to organ’s transplantation. These advantages should eventually lead to lower-cost and more efficient production of the cell sheets.

This technology is supported by the PCT Patent International Application No. PCT/US2022/047381 filed on October 21, 2022, entitled “Engineering of Stratified Cell Sheets Using Human Mesenchymal Stem Cells”.

Device Measuring Cell Sheets Transparency

We have developed a semi-automatic device for quality control in the cell-sheet manufacturing process. This device measures the maturation of the biological cell culture over-time to estimate the harvesting time of the cell sheets, number of cells present in one or more cell sheets of the biological cell culture, and transparency of biological cell culture. The

13

application of this device extends to ophthalmology to assess the transparency of donor’s cornea before transplantation. Currently there is no objective method to assess the donor’ cornea to understand readiness or compatibility.

This technology is supported by the PCT Patent International Application No. PCT/US2022/011267, entitled “System and Method of Evaluating Cell Culture,” filed on January 5, 2022.

Research and Development

We incurred $1.2 million and $1.7 million of research and development expenses in 2023 and 2022, respectively. The decrease was primarily due to completion of the sub-study under our Pilot/Phase 1 study of PGLG in diverticulosis in 2022 and suspension of further research and development activities in late 2023. Depending on the availability of funds, we may resume research and development of our existing product candidates in the future, and we may seek to acquire rights to one or more new product candidates.

Raw Materials and Manufacturing

The active pharmaceutical ingredient in Endari® is prescription grade L‑glutamine (“PGLG”) oral powder, which differs from non‑prescription grade L‑glutamine widely available as a nutritional supplement. Endari® is differentiated from ordinary L-glutamine by several factors, including the presence of a Drug Master File, oversight of purity and manufacturing at FDA inspected facilities, and stringent stability tested packaging. There are limited suppliers of PGLG worldwide, and we currently obtain substantially all our PGLG, directly or indirectly, from Ajinomoto Health and Nutrition North America, Inc. (“Ajinomoto”), a subsidiary of Ajinomoto North American Holdings, Inc.

Ajinomoto provided PGLG to us free of charge for our clinical trials of Endari®, including our Phase 3 trial. In return, we undertook to purchase from Ajinomoto substantially all our commercial needs for PGLG, subject to certain exceptions; however, we have no long-term supply agreement with Ajinomoto.

On June 16, 2017, we entered into an API supply agreement with Telcon (formerly, Telcon, Inc.), a South Korea-based company, pursuant to which Telcon paid us approximately ₩36.0 billion KRW (approximately $31.8 million) in consideration of the right to supply 25% of our requirements for bulk containers of PGLG for a 15-year term. The amount was recorded as a deferred trade discount. The API supply agreement provides for target annual revenue of more than $5,000,000 and annual “profit” (i.e., sales margin) to Telcon of at least $2,500,000 commencing in 2018. On July 12, 2017, we entered into a raw material supply agreement with Telcon which revised certain terms of the API supply agreement, which we refer to as the “revised API agreement.” The revised API agreement is effective for a term of five years and will renew automatically for 10 successive one-year renewal periods, except as either party may determine. In the revised API agreement, we have agreed to purchase a cumulative total of $47.0 million of PGLG over the term of the agreement. In September 2018, we entered into an agreement with Ajinomoto and Telcon to facilitate Telcon’s purchase of PGLG from Ajinomoto for resale to us under the revised API agreement. The PGLG raw material purchased from Telcon is recorded in inventory at net realizable value and the excess purchase price is recorded against deferred trade discount.

Our obligations under the agreements with Telcon are secured by a pledge of a convertible bond of Telcon purchased by us under a Convertible Bond Purchase Agreement dated September 28, 2020. See Notes 3, 5, 11 and 12 of the Notes to Consolidated Financial Statements in this Annual Report for more information regarding our obligations under the various agreements with Telcon.

In December 2019, EJ Holdings, Inc., or EJ Holdings a Japanese corporation that was 40% owned by us, purchased from Kyowa Hakko Bio Co. Ltd., or Kyowa, a subsidiary of Kyowa Hakko Kirin Co., Ltd., Kyowa’s phased-out facility in Ube, Japan, for the manufacture of L-glutamine and other amino acids. EJ Holdings is engaged in phasing in the plant, including obtaining FDA and other regulatory approvals for the manufacture of PGLG in accordance with current Good Manufacturing Practices (“cGMP”). EJ Holdings has had no revenues since its inception and depended on loans from us to acquire the Ube plant and fund its operations. In September 2023, we discontinued any further loans to EJ Holdings, and in December 2023, we sold and assigned our equity interest in EJ Holdings at our cost to Niihara International Inc., which was formed by Yutaka Niihara, M.D.,Ph.D., our former Chairman and Chief Executive Officer and one of our principal stockholders. EJ Holdings will be dependent on equity or loan financing from its new owner or other financing sources to continue its activities. As of December 31, 2023, we had loaned EJ Holdings a total of $25.8 million. EJ Holdings is expected to require substantial financing in order bring the Ube plant online. Under the asset purchase agreement pursuant to which EJ Holdings purchased the Ube plant, Kyowa has the right to repurchase the plant at the purchase price of $10.4 million plus certain taxes paid by EJ Holdings if the plant does not become operational within a reasonable period not to exceed five years, or approximately the end of 2024.

14

Endari® and any other commercial products we develop must be manufactured and packaged by facilities that meet FDA requirements for cGMP. We believe that Ajinomoto and the packager of Endari® meet FDA cGMP. Previous compliance with cGMP, however, does not guarantee future compliance. We have no long-term agreement with Ajinomoto. We may seek to enter into long-term supply agreements in the future and to establish one or more arrangements with alternative suppliers.

Historically, we have relied upon a single packager of Endari® with which we have no firm commitment to continue its services. The packager repeatedly delayed the packaging of Endari® originally scheduled for December 2023, which resulted in a severe shortage of finished goods inventory and materially, adversely affected our Endari® sales in the first quarter of 2024 and the first two months of the second quarter. Although the scheduled packaging has now been completed and we have begun to fill the order backlog, we are seeking additional sources of packaging to avoid similar problems in the future. There is no assurance that we can retain suitable packaging sources or, if we do, that we will not experience delays in the production of finished goods or future shortages of Endari®.

Competition

The biopharmaceutical industry is highly competitive and subject to rapid and significant technological change. We face potential competition from both large and small pharmaceutical and biotechnology companies, academic institutions, governmental agencies (such as the National Institutes of Health) and public and private research institutions. Many of our competitors and potential competitors have far greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, marketing and selling approved products. Historically, for example, we have had insufficient financial resources to engage in meaningful advertising or marketing of Endari®. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future. The key competitive factors affecting the success of each of our product candidates, if approved, are likely to be their safety, efficacy, convenience, price, the level of proprietary and generic competition, and the availability of coverage and reimbursement from government and other third‑party payors. Our Endari® sales may suffer or our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer or more effective, have fewer or less severe side effects, or are more convenient or less expensive than any products that we may develop. Our competitors may also obtain FDA or other regulatory approval for their product candidates more rapidly than we may be able to do so for any existing or new product candidates of ours, which could result in their establishing a strong market position before we are able to enter the market.

Sickle Cell Disease

Endari® is approved as a therapy to reduce the acute complications of SCD in adult and pediatric patients 5 years of age and older. The other drugs which are indicated to treat sickle cell disease are hydroxyurea (marketed as DROXIA or Hydrea by Bristol-Myers Squibb Company and available in generic form), which is approved to reduce the frequency of painful crises and need for blood transfusions in patients with sickle cell anemia for the treatment of adults with SCD; Voxelotor (marketed as Oxbryta™ by Pfizer Inc.) tablets for the treatment of SCD in adults and children 4 years of age and older; and crizanlizumab (marketed as Adakveo® by Novartis International AG) intravenous infusion approved to reduce the frequency of VOCs in adult and pediatric patients ages 16 years and older with SCD. Several companies are also developing product candidates for chronic treatment in SCD, and several other companies are in clinical trials to investigate new treatments for SCD.

Endari® also faces potential competition from one-time therapies for treating patients with severe SCD, including LentiGlobin BB305, which is being developed by bluebird bio, Inc. to treat SCD by inserting a functional human beta-globin gene into a patient’s hematopoietic stem cells, or HSCs, ex vivo and then transplanting the modified HSCs into the patient’s bloodstream. Bluebird has indicated its plans to pursue an accelerated development and approval pathway for its gene therapy product in SCD. Others are seeking to develop one-time therapies such as hematopoietic stem cell transplantation, gene therapy and gene editing, including Casegeyy, a groundbreaking CRISPR-based gene editing therapy from Vertex Pharmaceuticals and CRISPR Therapeutics approved by the FDA in December 2023, and a second recently approved treatment using conventional gene therapy, bluebird bio's lentiviral therapy, Lyfgenia. It is too early to predict the impact of these new treatments, but their availability may adversely affect the market for Endari® in the U.S. and elsewhere.

15

We are also aware of efforts to develop cures for SCD through approaches such as bone marrow treatments. Although bone marrow transplant is currently available for SCD patients, its use is limited by the lack of availability of matched donors and by the risk of serious complications, including graft versus host disease and infection.

The marketing exclusivity of Endari® in the U.S. afforded by its Orphan Drug designation will expire in July 2024, after which time we expect that Endari® will compete with generic versions of prescription-grade L-glutamine. The availability of generic prescription-grade L-glutamine products may cause payors to reduce their reimbursement rates for Endari® and otherwise adversely affect Endari® sales in the U.S. Endari® also competes with non-prescription grade L-glutamine, which is widely available as a dietary supplement at substantially lower prices than Endari®. Dietary supplements may be marketed without FDA approval, are generally not reimbursed by payors and are not subject to the rigorous quality control standards required by regulatory authorities for prescription drug products. Also, unlike prescription drugs, manufacturers of dietary supplements may not make claims that the supplements will cure, mitigate, treat or prevent disease, and we are not aware of any reports in peer-reviewed literature regarding the effectiveness of non-prescription grade L-glutamine supplements in treating SCD in controlled clinical trials.

Diverticulosis

There is no currently FDA-approved treatment for diverticulosis.

Oncology Treatment

IRAK-4 is a popular targeted pathway of inflammatory diseases, including cancers. In our pre-clinical studies, Kainos’s novel IRAK-4 inhibitor, referred to as KM10544, has shown promising signs of efficacy against FLT-3 positive leukemia cell lines and other hematological malignancy cell lines such as Waldenstrom Macroglobulinemia cell line.

KM10544 technology is supported by the PCT Patent International Application No. PCT/US2022/023632, entitled “Compositions and Methods For Treating Cancer”, filed on April, 6 2022.

Chondrocyte Cell Sheet Technology

Currently, no cell therapy to treat damaged bone has been approved by the FDA, using mesenchymal stem cells and only 1 cell therapy was approved by the FDA to treat cartilage (Tradename: MACI). However, MACI approved therapy requires the use of porcine collagen membrane, the use of animal product (serum) and it is an autologous transplantation of patient’s cartilage. MACI cell therapy can’t be used for patient’s carrying genetic mutation or for patients with no cartilage. According to available data from clinicaltrial.gov, there is only one clinical trial of the efficacy of cartilage cell sheets, “Safety and Efficacy Study of Cells Sheet-Autologous Chondrocyte Implantation to Treat Articular Cartilage Defects (CS-ACI)” (Xijing Hospital, Xi'an Shi, China; Tangdu Hospital, Xi’an Shi, China; Xi’An Honghui Hospital, Xi'an Shi, China) (ClinicalTrials.gov Identifier: NCT01694823).

The development of cell sheets using mesenchymal stem cells (e.g adipose stromal cells), may lead to new treatments of patients. In addition, the cell sheets were engineered using animal-free culture media and have the potential translational application for allogeneic transplantation. Our cell sheet therapy also makes possible to layer different types of cell sheets by harvesting the cell sheet without the use of harmful enzymes (trypsin or dispase) that may damage the cell‑based therapy and potentially to construct in vitro stratified tissue equivalents by alternately layering different types of harvested cell sheets to provide regenerated tissue architectures, resembling human tissues. For example, cartilage cell sheets can be layered on the top of a bone cell sheet before transplantation if the patient’s health condition requires it. This technique holds promise for the study of cell‑cell communications and angiogenesis in reconstructed, three‑dimensional environments, as well as for tissues engineering with complex, multicellular architectures, and drug-screening.

Device Measuring Cell Sheets Transparency

Currently, there is no device on the market that can measure the transparency or maturation of cell sheets. This device was created to be used as a quality control tool. The device will allow us to follow up the maturity of biological cell cultures, to estimate the time for cell sheet harvesting, as well as to estimate the number per cell sheet using a non-invasive methodology (part of the physical cell sheet property). Knowing the number of cells per cell sheet is a critical information for federal agencies, and there is no methodology to know the number of cells per cell sheet, besides digesting the whole cell sheet using enzyme (making the cell sheet non transplantable). This semi-automatic device will become an essential tool for quality control in the growing field of cell sheet translational medicine. The potential application of this device includes assessment of the transparency of donor’s cornea before transplantation. Currently, there is no objective method to assess the timing for cell sheet harvesting and to assess the donor’s cornea transparency for corneal transplantation. We have filed a

16

patent application in the U.S. for this technology and are in the process of improving the device. We may seek a potential partner to develop or commercialize the device and expand the application of the device.

Government Regulation

The FDA has granted Endari Orphan Drug designation and the EC has granted our PGLG Orphan Medicinal designation for the treatment of SCD.

Orphan Drug Designation. The FDA has authority under the U.S. Orphan Drug Act to grant Orphan Drug designation to a drug or biological product intended to treat a rare disease or condition. This law defines a rare disease or condition generally as one that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of the development and distribution of the orphan product in the United States will be recovered from sales of the product. Being granted Orphan Drug designation provides tax benefits to mitigate expenses of developing the orphan product. More importantly, Orphan Drug designation provides seven years of market exclusivity if the product receives the first FDA approval for the disease or condition for which it was granted such designation and the indication for which approval is granted matches the indication for which Orphan Drug designation was granted. During the seven-year exclusivity period, Orphan Drug exclusivity precludes FDA approval of a marketing application for the same active ingredient for the same indication. Orphan Drug exclusivity is limited and will not preclude the FDA from approving the same active ingredient for the same indication if the same product is shown to be clinically superior to the product previously granted exclusivity. In addition, a product that is the same as the orphan product may receive approval for a different indication (whether orphan or not) during the exclusivity period of the orphan product. Also, Orphan Drug market exclusivity will not bar a different product such as Pfizer Inc.’s Oxbryta to treat the same orphan disease or condition from obtaining its own Orphan Drug designation and Orphan Drug exclusivity.

The Orphan Drug designation for Endari will expire July 7, 2024, after which date Endari may face competition in the U.S. from generic PGLC products. In the meantime, we may seek to pursue improvements and reformulations of Endari to seek preserve our intellectual property rights in Endari following the expiration of its Orphan Drug designation. There is no assurance that any such improvements or reformulations would be successful.

Orphan Medicinal status in the EU has similar benefits, including a ten-year marketing exclusivity period following marketing authorization in the EU.

There is no designation available in countries in the MENA region similar to Orphan Drug or Orphan Medicinal designations, so we are not entitled to marketing exclusivity for Endari® in countries in the region where we obtain marketing authorization.

505(b)(2) Applications. Under Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act (“FD&C Act”), a person may submit an NDA for which one or more of the clinical studies relied upon by the applicant for approval were not conducted by or for the applicant and for which the applicant does not have a right of reference or use from the person by or for whom the clinical studies were conducted. Instead, a 505(b)(2) applicant may rely on published literature containing the specific information (e.g., clinical trials, animal studies) necessary to obtain approval of the application. The applicant may also rely on the FDA’s finding of safety and/or effectiveness of a drug previously approved by the FDA when the applicant does not own or otherwise have the right to access the data in that previously approved application. The 505(b)(2) pathway to marketing authorization thus allows an applicant to submit a NDA without having to conduct its own studies to obtain data that are already documented in published reports or previously submitted NDAs. In addition to relying on safety data from the Phase 2 and 3 studies of Endari®, we intend to take advantage of the 505(b)(2) pathway to the extent published literature will further support any NDA for PGLG.

Regulation by United States and foreign governmental authorities is a significant factor in the development, manufacture and expected marketing of our product candidates and in our ongoing research and development activities. The nature and extent to which such regulation will apply to us will vary depending on the nature of the product candidates we seek to develop.

Human therapeutic products, such as drugs, biologics and cell-based therapies, are subject to rigorous preclinical and clinical testing and other preapproval requirements of the FDA and similar regulatory authorities in other countries. Various federal and state statutes and regulations govern and influence pre- and post-approval requirements related to research, testing, manufacturing, labeling, packaging, storage, distribution and record keeping of such products to ensure the safety and effectiveness for their intended uses. The process of obtaining marketing approval and ensuring post approval compliance with the FD&C Act for drugs and biologics (and applicable provisions of the Public Health Service Act for biologics), and the regulations promulgated thereunder, and other applicable federal and state statutes and regulations,

17

requires substantial time and financial resources. Any failure by us or our collaborators to obtain, or any delay in obtaining, marketing approval could adversely affect the marketing of any of our product candidates, our ability to receive product revenues, and our liquidity and capital resources.

The manufacture of these products is subject to cGMP regulations. The FDA inspects manufacturing facilities for compliance with cGMP regulations before deciding whether to approve a product candidate for marketing.

The steps required by the FDA before a new product, such as a drug, biologic or cell-based therapy, may be marketed in the United States include:

In addition to obtaining FDA approval for each product candidate before we can market it as a product, the manufacturing establishment from which we obtain it must be registered and is subject to periodic FDA post approval inspections to ensure continued compliance with cGMP requirements. If, as a result of these inspections, the FDA determines that any equipment, facilities, laboratories, procedures or processes do not comply with applicable FDA regulations and the conditions of the product approval, the FDA may seek civil, criminal, or administrative sanctions and/or remedies against us, including the suspension of the manufacturing operations, recalls, the withdrawal of approval and debarment. Manufacturers must expend substantial time, money and effort in the area of production, quality assurance and quality control to ensure compliance with these standards.

Preclinical testing includes laboratory evaluation of the safety of a product candidate and characterization of its formulation. Preclinical testing is subject to Good Laboratory Practice (“GLP”) regulations. Preclinical testing results are submitted to the FDA as a part of an IND which must become effective prior to commencement of clinical trials. Clinical trials are typically conducted in three sequential phases following submission of an IND. In Phase 1, the product candidate under investigation (and therefore often called an investigational product) is initially administered to a small group of humans, either patients or healthy volunteers, primarily to test for safety (e.g., to identify any adverse effects), dosage tolerance, absorption, distribution, metabolism, excretion and clinical pharmacology, and, if possible, to gain early evidence of effectiveness. In Phase 2, a slightly larger sample of patients who have the condition or disease for which the investigational product is being studied receive the investigational product to assess the effectiveness of the investigational product, to determine dose tolerance and the optimal dose range, and to gather additional information relating to safety and potential adverse effects. If the data show the investigational product may be effective and has an acceptable safety profile in the targeted patient population, Phase 3 studies, also referred to as pivotal studies or enabling studies, are initiated to further establish clinical safety and provide substantial evidence of the effectiveness of the investigational product in a broader sample of the general patient population, to determine the overall risk benefit ratio of the investigational product, and provide an adequate basis for physician and patient labeling. During all clinical studies, Good Clinical Practice (“GCP”) standards and applicable human subject protection requirements must be followed. The results of the research and product development, manufacturing, preclinical studies, clinical studies, and related information are submitted in a NDA to the FDA.

The process of completing clinical testing and obtaining FDA approval for a new therapeutic product, such as a drug, biologic or cell-based product, is likely to take years and require the expenditure of substantial resources. If a NDA is submitted, there can be no assurance that the FDA will file, review, and approve it. Even after initial FDA approval has been

18

obtained, post market studies could be required to provide additional data on safety or effectiveness. Additional pivotal studies would be required to support adding other indications to the labeling. Also, the FDA will require post market reporting and could require specific surveillance or risk mitigation programs to monitor for known and unknown side effects of the product. Results of post marketing programs could limit or expand the continued marketing of the product. Further, if there are any modifications to the product, including changes in indication, manufacturing process, labeling, or the location of the manufacturing facility, a NDA supplement would generally be required to be submitted to the FDA prior to or corresponding with that change, or for minor changes in the periodic safety update report that must be submitted annually to the FDA.

The rate of completion of any clinical trial depends upon, among other factors, sufficient patient enrollment and retention. Patient enrollment is a function of many factors, including the size of the patient population, the nature of the trial, the number of clinical sites, the availability of alternative therapies, the proximity of patients to clinical sites, and the eligibility and exclusion criteria for the trial. Delays in planned patient enrollment might result in increased costs and delays. Patient retention could be affected by patient noncompliance, adverse events, or any change in circumstances making the patient no longer eligible to remain in the trial.

Failure to adhere to regulatory requirements for the protection of human subjects, to ensure the integrity of data, other IND requirements, and GCP standards in conducting clinical trials could cause the FDA to place a “clinical hold” on one or more studies of a product candidate, which would stop the studies and delay or preclude further data collection necessary for product approval. Noncompliance with GCP standards would also have a negative impact on the FDA’s evaluation of a NDA. If at any time the FDA finds that a serious question regarding data integrity has been raised due to the appearance of a wrongful act, such as fraud, bribery or gross negligence, the FDA may invoke its Application Integrity Policy (“AIP”) under which it could immediately suspend review of any pending NDA or refuse to accept the submission of a NDA as filed, require the sponsor to validate data, require additional clinical studies, disapprove a pending NDA or withdraw approval of marketed products, as well as require corrective and preventive action to ensure data integrity in future submissions. Significant noncompliance with IND regulations could result in the FDA not only refusing to accept a NDA as filed but could also result in enforcement actions, including civil and administrative actions, civil money penalties, criminal prosecution, criminal fines and debarment. Whether or not FDA approval has been obtained, approval of a product by regulatory authorities in foreign countries must be obtained prior to the commencement of marketing the product in those countries.

The requirements governing the conduct of clinical trials and product approvals vary widely from country to country, and the time required for approval might be longer or shorter than that required for FDA approval. Although there are some procedures for unified filings for some European countries, in general, each country at this time has its own procedures and requirements.

In most cases, if the FDA has not approved a product candidate for sale in the United States, the unapproved product may be exported to any country in the world for clinical trial or sale if it meets U.S. export requirements and has marketing authorization in any listed country without submitting an export request to the FDA or receiving FDA approval to export the product, as long as the product meets the regulatory requirements of the country to which the product is being exported. Listed countries include each member nation in the European Union or the European Economic Area, Canada, Australia, New Zealand, Japan, Israel, Switzerland and South Africa. If an unapproved product is not approved in one of the listed countries, the unapproved product may be exported directly to an unlisted country if the product meets the requirements of the regulatory authority of that country, and the FDA determines that the foreign country has statutory or regulatory requirements similar or equivalent to the United States.

In addition to the regulatory framework for product approvals, we and our collaborative partners must comply with federal, state and local laws and regulations regarding occupational safety, laboratory practices, the use, handling and disposition of radioactive materials, environmental protection and hazardous substance control, and other local, state, federal and foreign regulation. All facilities and manufacturing processes used by third parties to produce our product candidates for clinical use in the United States and our products for commercialization must comply with cGMP requirements and are subject to periodic regulatory inspections. The failure of third-party manufacturers to comply with applicable regulations could extend, delay or cause the termination of clinical trials conducted for our product candidates or the withdrawal of our products from the market. The impact of government regulation upon us cannot be predicted and could be material and adverse. We cannot accurately predict the extent of government regulation that might result from future legislation or administrative action.

19

Patents, Proprietary Rights and Know‑How

We have relied to date on a combination of patent licenses, trademark rights, trade secret protection, distribution agreements, manufacturing agreements, manufacturing capability and other unpatented proprietary information to protect our intellectual property rights. While we do not currently own any issued patents directed to the treatment of sickle cell anemia, we do own patent applications in that area, as well as issued patents and patent applications directed to the treatment of diverticulosis, diabetes and hypertriglyceridemia. We have Orphan Drug market exclusivity for the treatment of sickle cell anemia with Endari® in the United States through July 7, 2024 and, if approved in the EU, for ten years from the approval date. We may seek to pursue improvements and reformulations of Endari® to preserve our intellectual property rights in Endari following the expiration of its Orphan Drug designation.

We also rely on employee agreements to protect the proprietary nature of our products. We require that our officers and key employees enter into confidentiality agreements that require these officers and employees to assign to us the rights to any inventions developed by them during their employment with us.

Patents

We have issued patents related to compositions including PGLG and methods involving administration of PGLG for the treatment of diverticulosis in the United States, Europe, Japan, Australia, India, Mexico, China, Indonesia, Korea and Russia. Associated patent applications are currently pending in the United States, the EU, Brazil, Korea and Russia.

Patents directed to compositions for decreasing HbA1C levels in individuals who are shown to have average blood sugar levels in the diabetic range have issued in Japan, Indonesia and the Philippines. Associated applications are currently pending in the United States, Europe, Brazil, India, China, the Philippines, and Japan.

We have issued patents directed to the treatment of hypertriglyceridemia in Japan and the Philippines. A corresponding European patent application has been granted and is currently the subject of an Opposition proceeding. Associated applications are pending in the United States, Brazil, India, China, and the Philippines.

A patent application directed to the treatment of sickle cell using a multi-component composition is pending in the United States and Europe. An international application directed to the same invention has been filed under the Patent Cooperation Treaty.

We have a pending international (PCT) patent application directed to the treatment of cancers with KM10544, alone or in combination with a Bruton Tyrosine Kinase (BTK) inhibitor or a Poly (ADP-ribose) polymerase (PARP) inhibitor. The cancers being treated may have a MyD88 mutation (e.g., the L265P missense mutation) and can include hematologic cancers, such as Waldenstrom Macroglobulemia (WM), Acute Myeloid Leukemia (AML), and diffuse large B-cell lymphoma (DLBCL), and solid tumors such as rectal cancer, pancreatic cancer, and small cell lung cancer. The application is expected to enter into national stages by June 2024 and has a projected expiration date in 2042.

We have a pending PCT patent application directed to devices and methods for measuring the cell sheets maturation, in Brazil, China, European Union, Eurasia, India, Japan, South Korea and USA. The technology is important for the preparation and use of stem cell-derived cells sheets, such as corneas, cartilage, epithelial cell sheets and cell sheets. This non-invasive approach can determine the time progression of cell sheet growth, the maturity of the cell sheet, and the number of cells per cell sheet before harvesting and transplantation. The application is expected to enter into national stages by July 2023 and has a projected expiration date in 2042.

We have a pending PCT patent application directed to the preparation and use of cell sheets. The prepared cell sheets can be used for the treatment of cartilage-related conditions such as cartilage injury and osteoarthritis, and bone diseases such as nonunion bone diseases and Paget’s disease. The cell sheets can be formed of a multilayer of cells grown and harvested in an intact cell sheet that can be transplanted as a patch on the injured area.

License Agreements

On October 7, 2021, we entered into a License Agreement with Kainos, under which Kainos granted us an exclusive license in the territory encompassing the U.S., the U.K. and the EU to patent rights, know-how and other intellectual property relating to Kainos’s IRAK4 inhibitor, referred to as KM10544, for the treatment of cancers, including leukemia, lymphoma and solid tumor cancers. In consideration of the license, we paid Kainos a six-figure upfront fee in cash and agreed to make future cash payments upon the achievement of specified milestones totaling in the mid-eight figures, a single-digit percentage

20

royalty based on net sales of the licensed products and a similar percentage of any sublicensing consideration. The License Agreement will continue on a licensed product-by-licensed product and country-by-country basis until the last to expire valid claim of any licensed patent in such country.

Trademarks